For the 24 hours to 23:00 GMT, the EUR declined 0.13% against the USD and closed at 1.1180, after the European Central Bank’s (ECB) President, Mario Draghi stated that there is no need to deviate from the ECB’s policy path, adding that premature tightening would lead to a fresh recession and more inequality as low interest rates had helped create jobs and foster growth in the economy.

On the macro front, Germany’s Ifo business climate index unexpectedly rose to a level of 115.1 in June, notching its highest level since 1991 and defying market expectations for a fall to a level of 114.5, suggesting that German business confidence is booming amid brighter growth prospects in the Euro-zone’s largest economy. The index had recorded a level of 114.6 in the previous month.

Moreover, the nation’s Ifo business expectations index registered an unexpected rise to a level of 106.8 in June, compared to a reading of 106.5 in the previous month, while markets were expecting the index to fall to a level of 106.4. Also, the nation’s Ifo current assessment index surprisingly advanced to a level of 124.1 in June, compared to market expectations for the index to remain steady at a level of 123.3.

Macroeconomic data released in the US indicated that preliminary durable goods orders eased more-than-expected by 1.1% on a monthly basis in May, compared to market consensus for a drop of 0.6%. In the previous month, durable goods orders had dropped 0.8%. Additionally, the nation’s Dallas Fed manufacturing business index declined more-than-anticipated to a level of 15.0 in June, compared to a reading of 17.2 in the prior month. Also, the nation’s Chicago Fed national activity index dropped more-than-expected to a level of -0.26 in May, compared to a revised reading of 0.57 in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.1187, with the EUR trading 0.06% higher against the USD from yesterday’s close.

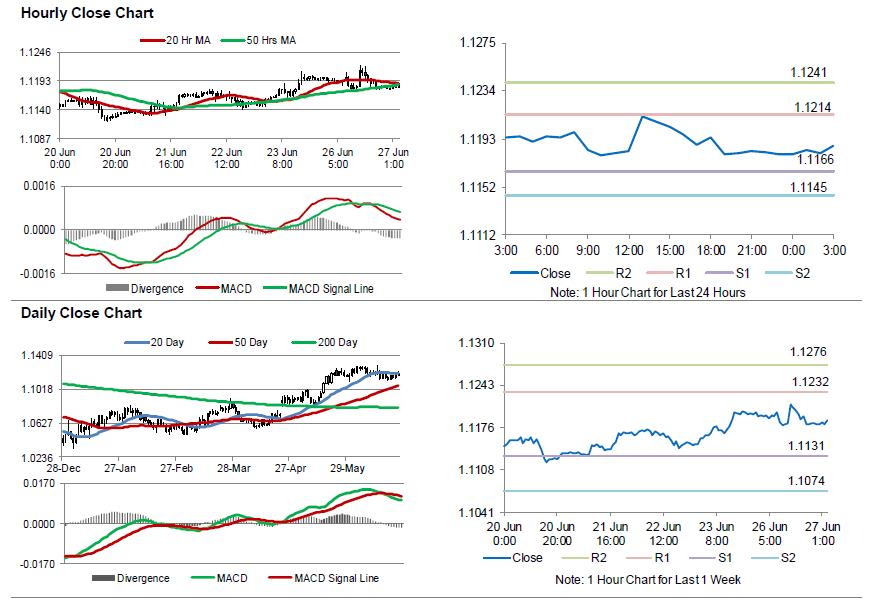

The pair is expected to find support at 1.1166, and a fall through could take it to the next support level of 1.1145. The pair is expected to find its first resistance at 1.1214, and a rise through could take it to the next resistance level of 1.1241.

With no major economic releases in the Euro-zone today, investors will look forward to the US consumer confidence index for June, slated to release later in the day. Also, market participants will draw their attention to a speech by the Federal Reserve (Fed) Chair, Janet Yellen, for clues on the timing of further rate hikes and plans to trim the Fed’s balance sheet.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.