For the 24 hours to 23:00 GMT, the EUR declined 0.42% against the USD and closed at 1.1711, after minutes of the European Central Bank (ECB) highlighted concerns over the rapid appreciation of the Euro.

Minutes of the ECB’s latest meeting showed discussion among members on various options to extending its asset buying, including the choice between the pace and the intended duration. Further, it showed that policymakers admitted the need of a substantial monetary policy for a little longer period of time to ensure that inflation’s returns to the central bank’s target and “broadly agreed” that October’s meeting would be the right time for “the bulk of the decisions”. Minutes also showed that officials fretted over Euro’s strength and its impact on the nascent economic recovery.

Other economic data showed that Germany’s Markit construction PMI dropped to a level of 53.4 in September, compared to a reading of 54.9 in the prior month.

The greenback gained ground against its major peers, after the latest string of economic reports painted a bright picture of the US economy.

Data revealed that initial jobless claims in the US eased more-than-expected to a level of 260.0K in the week ended 30 September, compared to a level of 272.0K in the previous week, while markets were anticipating for a fall to a level of 265.0K. Further, the nation’s trade deficit narrowed to an eleven-month low of $42.4 billion in August, as exports of goods and services rose to a nearly three-year high. The nation had posted a revised trade deficit of $43.6 billion in the previous month, while investors had expected the country’s trade deficit to narrow to $42.7 billion.

Another set of data revealed that the final durable goods orders in the US climbed more than initially estimated by 2.0% on a monthly basis in August, while the preliminary print had indicated a rise of 1.7%. Durable goods orders had registered a decline of 6.8% in the prior month. Moreover, the nation’s factory orders rebounded 1.2% on a monthly basis in August, more than market consensus for a rise of 1.0%. Factory orders had dropped 3.3% in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.1706, with the EUR trading marginally lower against the USD from yesterday’s close.

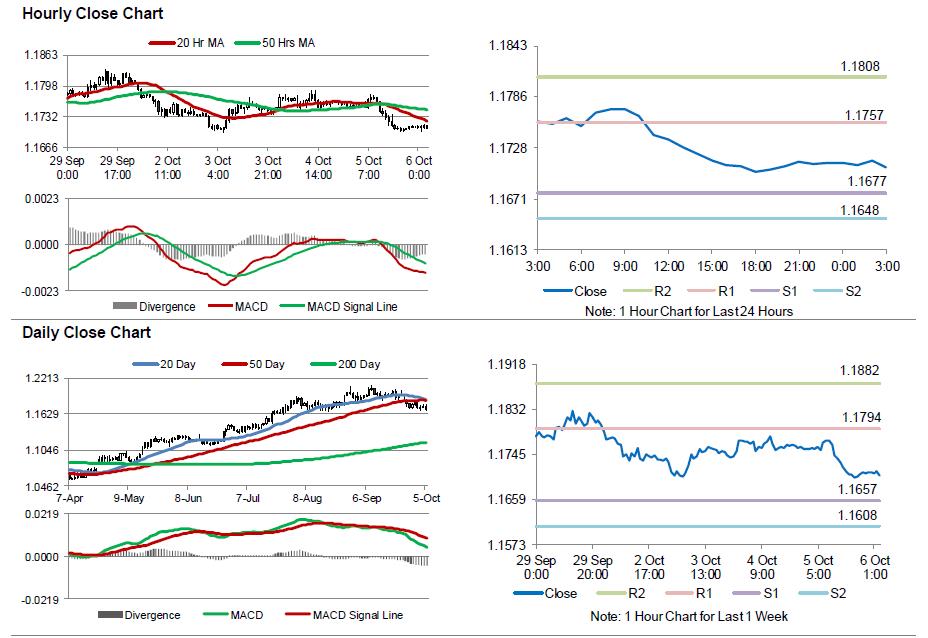

The pair is expected to find support at 1.1677, and a fall through could take it to the next support level of 1.1648. The pair is expected to find its first resistance at 1.1757, and a rise through could take it to the next resistance level of 1.1808.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.