For the 24 hours to 23:00 GMT, the EUR declined 0.42% against the USD and closed at 1.1728, following the release of dovish minutes from the European Central Bank’s July meeting.

According to minutes, policymakers expressed concerns over stubbornly low inflation as well as continuous strength in the Euro and were highly aware of the risk that an excessive rise in the currency could threaten the central bank’s efforts to spur inflation.

On the macro front, the Euro-zone’s final consumer price index (CPI) rose 1.3% on an annual basis in July, confirming the preliminary print. In the prior month, the CPI had registered a similar rise. Additionally, the region’s seasonally adjusted trade surplus widened more-than-anticipated to a level of €22.3 billion in June, notching its highest in six-months. Markets were expecting the region to post a surplus of €20.3 billion, after recording a revised surplus of €19.0 billion in the previous month.

The US Dollar traded mostly higher against a basket of currencies, after data indicated that initial jobless claims in the US dropped to a six-month low level of 232.0K in the week ended 12 August, higher than market consensus for a fall to a level of 240.0K. In the prior week, initial jobless claims had recorded a level of 244.0K. Moreover, the nation’s leading indicators rose 0.3% in July, meeting market expectations and compared to an advance of 0.6% in the previous month.

Another set of data showed that industrial production in the US climbed 0.2% on a monthly basis in July, undershooting market consensus for a gain of 0.3%. Industrial production had risen 0.4% in the previous month. On the other hand, the nation’s manufacturing production recorded an unexpected drop of 0.1% MoM in July, defying market expectations for a rise of 0.2%. In the previous month, manufacturing production had increased 0.2%.

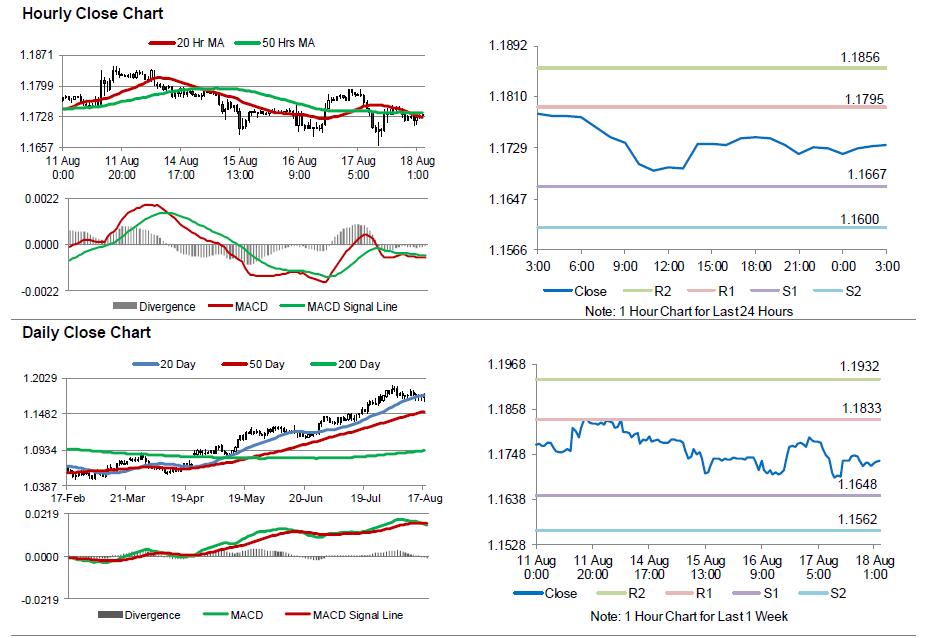

In the Asian session, at GMT0300, the pair is trading at 1.1733, with the EUR trading slightly higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1667, and a fall through could take it to the next support level of 1.1600. The pair is expected to find its first resistance at 1.1795, and a rise through could take it to the next resistance level of 1.1856.

Going ahead, investors will look forward to the Euro-zone’s construction output data for June, slated to release in a few hours. Additionally, the US flash Reuters/Michigan consumer confidence index for August, scheduled to release later today, will be on investors’ radar.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.