For the 24 hours to 23:00 GMT, the EUR declined 0.17% against the USD and closed at 1.1258, following a report that the European Central Bank (ECB) will likely cut its inflation forecast at its monetary policy meeting scheduled later today.

In economic news, data indicated that Germany’s seasonally adjusted factory orders eased more-than-expected by 2.1% on a monthly basis in April, after advancing for two consecutive months, while markets expected for a fall of 0.3%. In the previous month, factory orders had recorded a revised rise of 1.1%.

Meanwhile, the Organisation for Economic Co-operation and Development (OECD), in its latest economic outlook report, lifted the Euro-zone’s growth forecast to 1.8% for this and next year, up from 1.6% for both years, boosted by strong growth in Germany. Additionally, the OECD called for winding down the European Central Bank (ECB) massive bond purchases in 2018 and raise one of its key interest rates by the end of 2018.

Separately, it revised up its 2017 global growth forecast by 0.2% and estimated that the global economy will likely expand by 3.5% in 2017, its fastest pace of growth in 6 years, before accelerating by 3.6% in 2018, as a rebound in global trade trounces fears of a weaker economic outlook in the US. On the contrary, growth forecast for the US was downgraded to 2.1% this year and 2.4% next year, down from its earlier prediction of 2.4% and 2.8%, respectively, due to delays by the Trump administration to push through with its planned tax cuts and infrastructure spending.

Macroeconomic data revealed that mortgage applications in the US rebounded 7.1% in the week ended 02 June 2017, following a drop of 3.4% in the previous week.

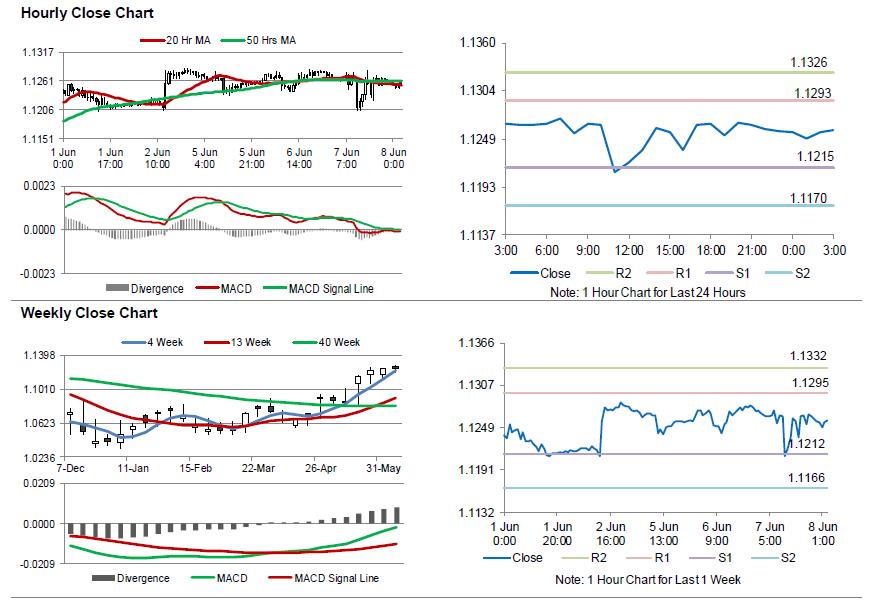

In the Asian session, at GMT0300, the pair is trading at 1.1259, with the EUR trading slightly higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1215, and a fall through could take it to the next support level of 1.1170. The pair is expected to find its first resistance at 1.1293, and a rise through could take it to the next resistance level of 1.1326.

Going ahead, all eyes would be on the European Central Bank’s (ECB) interest rate decision, wherein markets would be keen to know whether the ECB would announce tapering of its massive stimulus programme. Additionally, the Eurozone’s 1Q GDP and Germany’s industrial production data for April, slated to release in a few hours, will be on investors’ radar. Meanwhile, the US initial jobless claims data will also be eyed by traders.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.