For the 24 hours to 23:00 GMT, the EUR declined 0.24% against the USD and closed at 1.2249.

Yesterday, the European Central Bank (ECB), in its latest economic bulletin report, stated that the Euro-zone economy is expected to continue its robust pace of economic expansion beyond the near term. While the central bank noted that economic progress was yet to bring a self-sustaining rise in inflation, it indicated that officials grew more confident that inflation will eventually converge towards its 2.0% inflation target.

In economic news, Germany’s seasonally adjusted trade surplus narrowed more-than-estimated to €18.2 billion in December, compared to a surplus of €23.7 billion in the previous month, while markets were expecting the country’s trade surplus to drop to €21.0 billion.

Macroeconomic data revealed that the number of Americans filing for fresh jobless claims unexpectedly dipped to a level of 221.0K in the week ended 03 February, dropping to its lowest level in nearly 45 years and pointing to a rapidly diminishing slack in the labour market. Initial jobless claims had registered a level of 230.0K in the prior week, while investors had envisaged for a rise to a level of 232.0K.

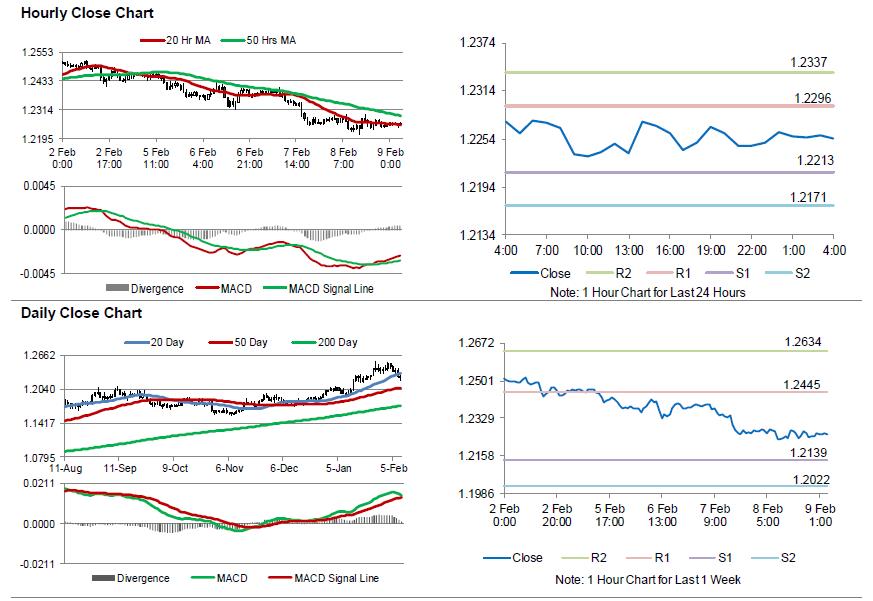

In the Asian session, at GMT0400, the pair is trading at 1.2255, with the EUR trading slightly higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2213, and a fall through could take it to the next support level of 1.2171. The pair is expected to find its first resistance at 1.2296, and a rise through could take it to the next resistance level of 1.2337.

With no major macroeconomic releases in the Euro-zone today, investors would focus on the US final wholesale inventories data for December, set to release later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.