For the 24 hours to 23:00 GMT, the EUR declined 0.78% against the USD and closed at 1.1641, after ECB confirmed to end its bond purchases in December 2018.

The European Central Bank (ECB), at its July monetary policy meeting, decided to keep the benchmark interest rate steady at 0.00%, in line with expectations and reiterated its guidance for its asset purchases. Meanwhile, the officials expect the key interest rates to remain at their present levels at least through the summer of 2019 and inflation close to 2.0% over the medium term. In a statement post-meeting, the ECB President, Mario Draghi, stated that euro area economic recovery is proceeding along its solid and broad-based path However, the risk of persistent heightened financial market volatility requires monitoring.

Macroeconomic data showed that Germany’s Gfk consumer confidence index unexpectedly eased to a level of 10.6 in August, compared to market consensus for an unchanged reading. In the prior month, the index had registered a reading of 10.7.

In the US, data indicated that seasonally adjusted initial jobless claims rose to 217.0K in the week ended 21 July 2018, compared to a revised level of 208.0K in the prior week. Market participants had anticipated initial jobless claims to rise to 215.0K. Moreover, advance goods trade deficit widened to $68.3 billion, more than market expectations for a deficit of $67.0 billion. In the preceding month, advance goods trade had recorded a deficit of $64.8 billion. Meanwhile, the nation’s preliminary durable goods orders rallied 1.0% on a monthly basis in June, undershooting market expectations for a gain of 3.0%. Durable goods orders had recorded a revised drop of 0.3% in the previous month. In the Asian session, at GMT0300, the pair is trading at 1.1652, with the EUR trading 0.09% higher against the USD from yesterday’s close.

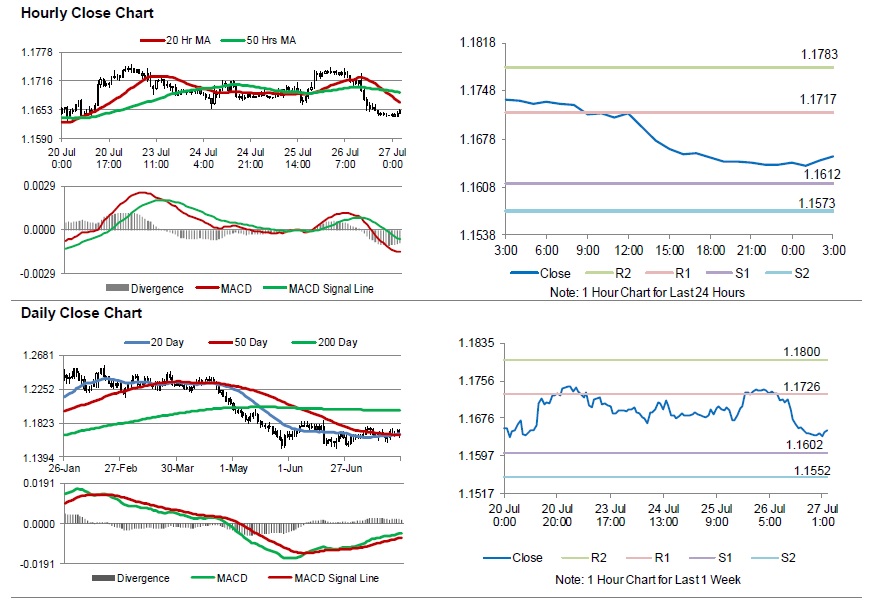

The pair is expected to find support at 1.1612, and a fall through could take it to the next support level of 1.1573. The pair is expected to find its first resistance at 1.1717, and a rise through could take it to the next resistance level of 1.1783.

Later in the day, investors would look forward to the release of US Q2 GDP data and the Michigan consumer sentiment index for July.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.