For the 24 hours to 23:00 GMT, the EUR rose 0.45% against the USD and closed at 1.1058.

On the data front, Euro-zone’s seasonally adjusted industrial production unexpectedly declined 0.4% on a monthly basis in July, defying market consensus for a rise of 1.0%. In the prior month, industrial production had recorded a revised drop of 1.4%.

Separately, in Germany, the final consumer price index (CPI) rose 1.4% on an annual basis in August, meeting market expectations and confirming the preliminary figures. In the prior month, the CPI had recorded a gain of 1.7%.

The European Central Bank (ECB), in its latest monetary policy meeting, opted to leave its key interest rate steady at 0.0%, as widely expected and indicated that the interest rate would remain at the current level or lower till its inflation outlook reaches near 2.0%. Further, the ECB slashed its deposit rate by 10 basis points to -0.5% from -0.4%. However, the central bank relaunched its quantitative easing programme entailing asset purchases of €20 billion per month from November. In a statement following the decision, the ECB President Mario Draghi, suggested government to take fiscal measures to improve the central bank’s monetary stimulus and revive the economy.

In the US, data showed that the consumer price index (CPI) rose 1.7% on a yearly basis in August, at par with market expectations. In the prior month, the CPI had recorded a rise of 1.8%. Moreover, the US seasonally adjusted initial jobless claims fell to a 5-month low level of 204.0K on a weekly basis in the week ended 07 September 2019, more than market expectations for a drop to a level of 215.00K and compared to a revised reading of 219.0K in the prior week. Meanwhile, the nation’s budget deficit widened to $200.0 billion in August, following a deficit of $119.7 billion in the previous month.

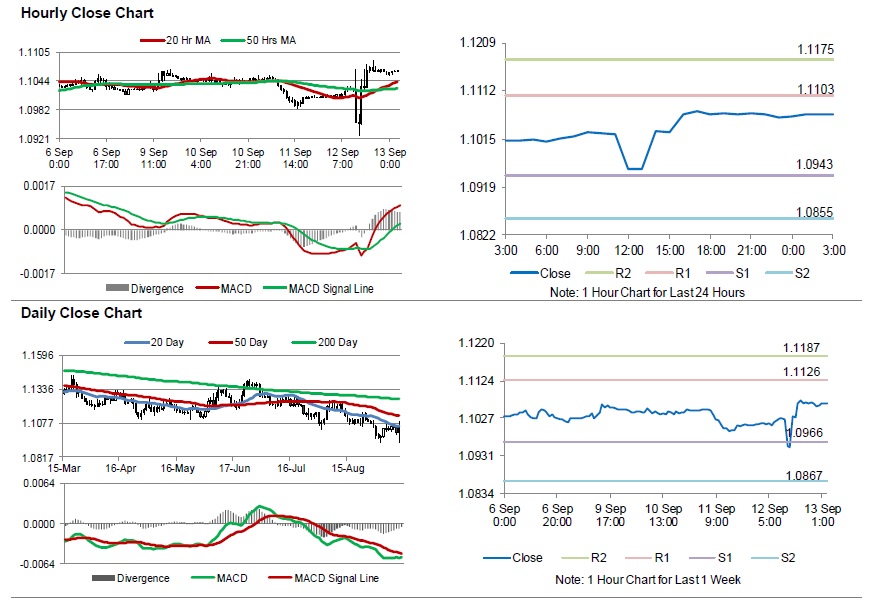

In the Asian session, at GMT0300, the pair is trading at 1.1066, with the EUR trading 0.07% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.0943, and a fall through could take it to the next support level of 1.0855. The pair is expected to find its first resistance at 1.1103, and a rise through could take it to the next resistance level of 1.1175.

Looking ahead, traders would keep an eye on Euro-zone’s trade balance data for July, set to release in a few hours. Later in the day, the US advance retail sales for August, the Michigan consumer sentiment index for September and business inventories for July, will be on traders’ radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.