For the 24 hours to 23:00 GMT, the EUR rose 0.06% against the USD and closed at 1.1309.

On the macro front, the Germany’s Markit construction PMI advanced to a level of 54.7 in February, following a reading of 50.7 in January.

The Organization for Economic Cooperation and Development (OECD), in its biannual Economic Outlook report, trimmed its 2019 global growth forecast to 3.3% from 3.5% projected in November. Moreover, the agency also slashed its 2020 growth projection to 3.4%. Furthermore, the OECD cautioned that escalating trade turmoil and uncertainties over Brexit are threatening the global growth outlook.

In the US, data showed that the ADP employment climbed by 183.0K in February, compared to market consensus for a rise of 190.0K. The private sector employment had recorded a revised increase of 300.0K in the prior month.

On the flipside, the nation’s trade deficit soared to a 10-year high level to $59.8 billion in December, amid trade dispute with China and compared to a revised deficit of $50.3 billion in the prior month. Market participants had envisaged the nation to post a deficit of $57.9 billion. Moreover, the mortgage applications retreated 2.5% on a weekly basis in the week ended 01 March 2019, compared to a rise 5.3% in the prior week.

The Federal Reserve’s (Fed) latest Beige Book revealed that most of the Fed districts witnessed ‘slight-to-moderate’ growth in late January and February. However, the partial government shutdown led to slower economic activity in about half of the districts. Further, the report revealed concerns over economic slowdown in 2019 and supported Fed officials pledge to remain patience on future interest-rate hikes.

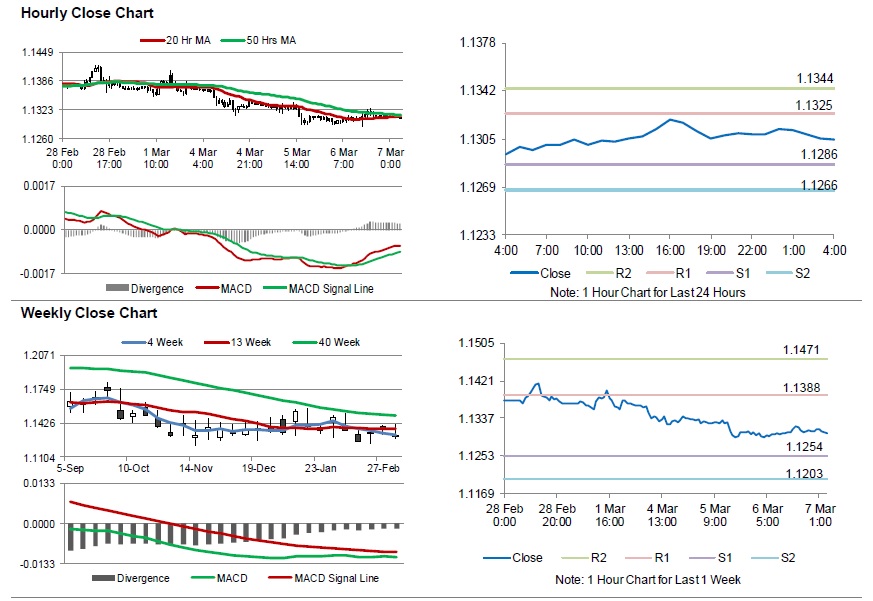

In the Asian session, at GMT0400, the pair is trading at 1.1305, with the EUR trading slightly lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1286, and a fall through could take it to the next support level of 1.1266. The pair is expected to find its first resistance at 1.1325, and a rise through could take it to the next resistance level of 1.1344.

Looking ahead, traders would keep an eye on the European Central Bank’s interest rate decision along with the Euro-zone’s gross domestic product for 4Q2018, due to release in a few hours. Later in the day, US consumer credit data for January followed by initial jobless claims, would pique significant amount of investors’ attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.