For the 24 hours to 23:00 GMT, the EUR declined 0.13% against the USD and closed at 1.0866, after the European Central Bank’s (ECB) President, Mario Draghi, brushed off calls to scale back its stimulus programme, reiterating that underlying inflation continues to remain subdued and lack a convincing upward trend.

On the macro front, data indicated that the US posted a more-than-expected budget surplus of $182.4 billion in April, compared to a deficit of $176.2 billion in the previous month, while markets were expecting the nation to post a surplus of $179.0 billion. Additionally, the nation’s MBA mortgage applications rebounded 2.4% in the week ended 05 May 2017, following a drop of 0.1% in the previous week.

Other economic data revealed that the export price index in the US advanced 0.2% on a monthly basis in April, meeting market expectations and compared to a revised rise of 0.1% in the previous month. Moreover, the nation’s import price index registered a rise of 0.5% MoM in April, beating market consensus for an advance of 0.1%. In the prior month, the index had recorded a revised rise of 0.1%.

In the Asian session, at GMT0300, the pair is trading at 1.0877, with the EUR trading 0.1% higher against the USD from yesterday’s close.

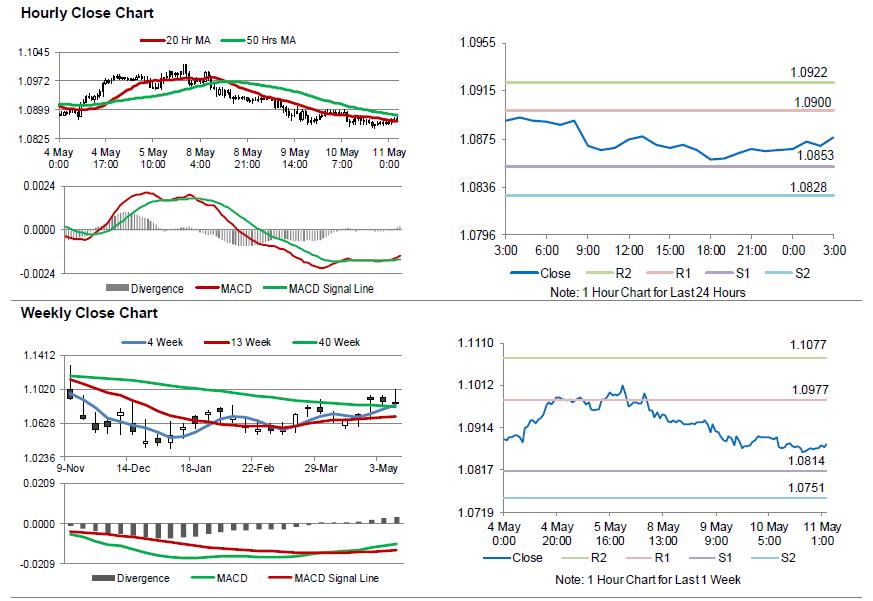

The pair is expected to find support at 1.0853, and a fall through could take it to the next support level of 1.0828. The pair is expected to find its first resistance at 1.0900, and a rise through could take it to the next resistance level of 1.0922.

Moving ahead, market participants will look forward to the ECB’s economic bulletin as well as the European Commission’s economic growth forecast reports, slated to release in a few hours. Moreover, in the US, weekly jobless claims data, scheduled to be released later in the day, will be on investors’ radar.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.