For the 24 hours to 23:00 GMT, the EUR rose 0.16% against the USD and closed at 1.1250, after Germany’s Ifo business climate index rose more-than-expected to a level of 109.5 in September, indicating that uncertainty created by the historic Brexit vote is fading. Markets anticipated the index to rise to a level of 106.3, compared to a level of 106.2 in the previous month. Additionally, the nation’s Ifo business expectations index unexpectedly advanced to a level of 104.5 in September, while markets expected the index to remain steady at a level of 100.1. Also, the nation’s Ifo current assessment index advanced to a level of 114.7 in September, higher than markets expectations for a rise to a level of 112.9 and following a level of 112.8 in the previous month.

Separately, in a testimony to European Parliament, the European Central Bank (ECB) Chief, Mario Draghi, stated that pursuing accommodative monetary policy will continue to provide effective support to the economic growth potential and the upward path to inflation. Further, he warned that Britain should not be granted any special favours on single-market access during negotiations over Brexit. He also added that so far the region’s economy appeared “resilient” to global and political uncertainty in the wake of the Brexit vote and acknowledged that measures taken by the Bank of England (BoE) and ECB had helped to avoid a “traumatic” reaction in financial markets.

Data indicated that US new home sales dropped less-than-expected by 7.6% MoM in August, to a level of 609.0K, compared to a reading of 654.0K in the prior month. Market anticipation was for new home sales to drop to 597.0K. Moreover, the nation’s Dallas Fed manufacturing index dropped to a level of -3.7 in September, surpassing market expectations for a fall to a level of -3.0 and after recording a reading of -6.2 in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.1244, with the EUR trading marginally lower against the USD from yesterday’s close.

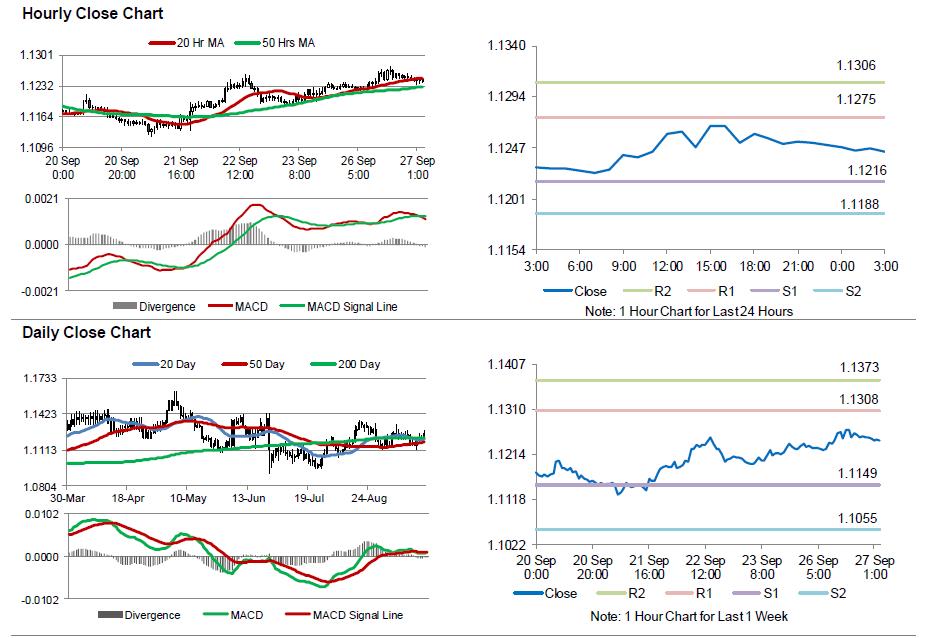

The pair is expected to find support at 1.1216, and a fall through could take it to the next support level of 1.1188. The pair is expected to find its first resistance at 1.1275, and a rise through could take it to the next resistance level of 1.1306.

Amid a lack of major economic releases in the Euro-zone today, market participants would look forward to the US consumer confidence and flash services PMI, both for September, scheduled to release later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.