On Friday, EUR declined 0.23% against the USD and closed at 1.3433, after the Ifo sentiment indices from Germany, Euro-zone’s largest economy, disappointed. Data showed that the German business sentiment dropped for a third consecutive month to 108.0 in July, its lowest level in nine months, compared to a level of 109.7 in the prior month. Additionally, the Ifo current assessment index too fell to 112.9 in July, compared to previous month’s level of 114.8. The Ifo expectations index too deteriorated in July. However, the Gfk reported that the German consumer morale notched a 7-year high level of 9.0 in August. Furthermore, the ECB in its monthly report revealed that the Private-sector lending in the region fell 1.7%, on an annual basis, compared to a drop of 2.0% in the previous month.

The common currency also came under pressure after the European Union increased its blacklist of Russians subject to sanctions and broad economic measures against Moscow. However, over the weekend, Russia criticised the additional sanctions imposed by the European Union over Moscow’s role in the Ukraine crisis.

Elsewhere, ECB Vice President Vitor Constancio, in an interview in Bangkok downplayed speculations for any more additional measures in the near term from the ECB, however indicated that the aggressive easing measures implemented by the central bank in the month of June would be more than enough to tackle the problem of too-low inflation in the Euro-zone.

The US Dollar was boosted after data released indicated that the durable goods orders from the US rebounded and rose 0.7%, on a monthly basis, in June, compared to a 1.0% decline in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.3431, with the EUR trading tad lower from Friday’s close.

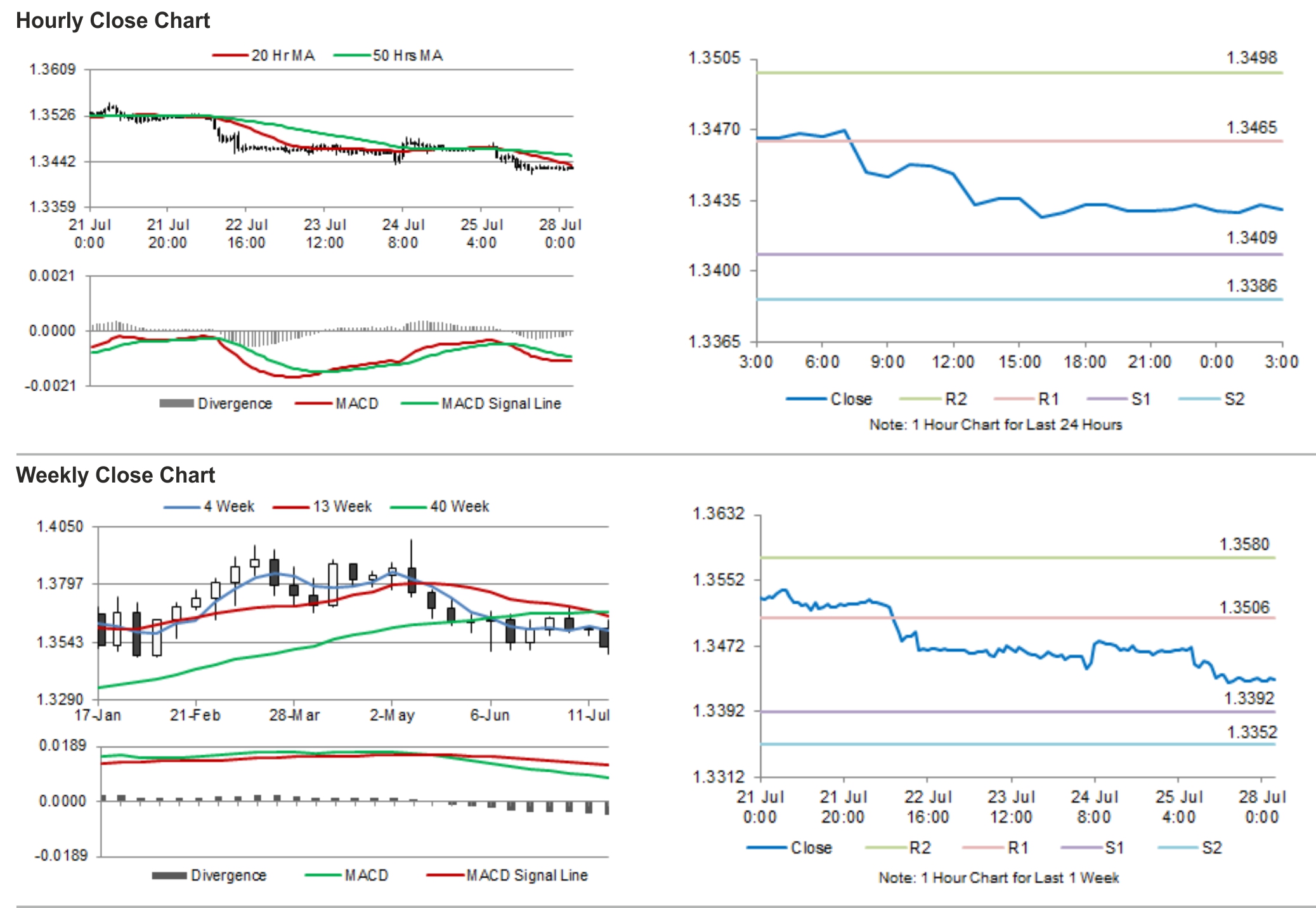

The pair is expected to find support at 1.3409, and a fall through could take it to the next support level of 1.3386. The pair is expected to find its first resistance at 1.3465, and a rise through could take it to the next resistance level of 1.3498.

Investors await the services and composite PMI numbers along with pending home sales data from the US to be released later during the day, however, the US Dollar would largely be influenced by the release of the GDP data from the US and the Federal Reserve’s interest rate decision slated later during the week.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.