For the 24 hours to 23:00 GMT, the GBP rose 0.35% against the USD and closed at 1.2665.

Data indicated that UK’s retail sales advanced 3.6% on an annual basis in November, buoyed by Black Friday promotions & record online spending and surpassing market expectations for a rise of 2.0%. In the previous month, retail sales had registered a revised gain of 2.4%.

The Bank of England (BoE), in its latest policy meeting, voted unanimously to leave its key interest rates unchanged at 0.75%, as widely. Further, the central bank lowered its growth forecast for Q4 2018 to 0.2% from 0.3%. Additionally, the bank expects inflation to fall below 2.0% in coming months due to lower oil prices. Moreover, policymakers warned that uncertainties surrounding Brexit are posing risks to the country’s growth outlook.

In the Asian session, at GMT0400, the pair is trading at 1.2655, with the GBP trading 0.08% lower against the USD from yesterday’s close.

Overnight data showed that UK’s Gfk consumer confidence fell to a 5.5-year low level of -14.0 in December, at par with market expectations and following a reading of -13.0 in the previous month. Additionally, the Lloyds business barometer eased to a level of 17.0% in December, compared to a level of 24.0 % in the preceding month.

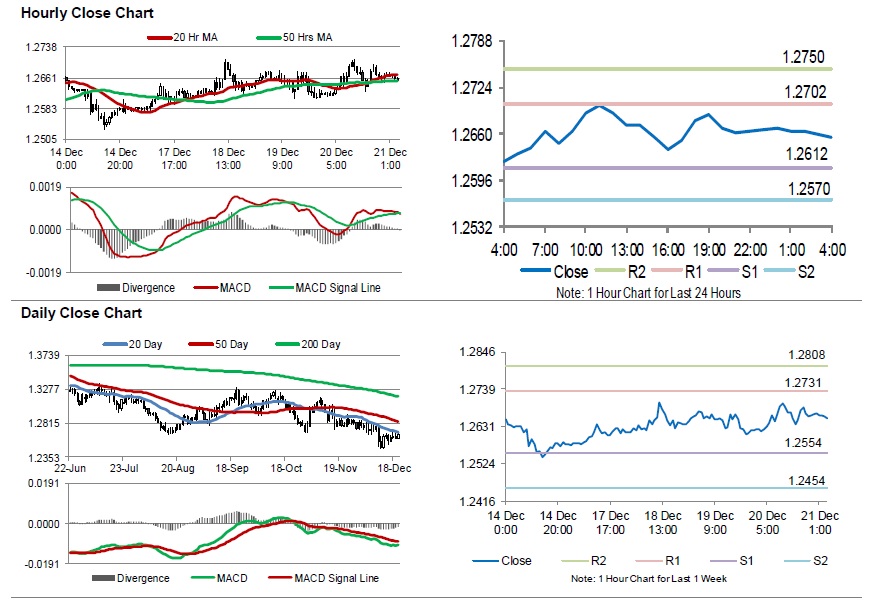

The pair is expected to find support at 1.2612, and a fall through could take it to the next support level of 1.2570. The pair is expected to find its first resistance at 1.2702, and a rise through could take it to the next resistance level of 1.2750.

Looking forward, traders would await UK’s 3Q gross domestic product figures and public sector net borrowing for November, set to release in a few hours.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.