For the 24 hours to 23:00 GMT, the GBP declined 0.29% against the USD and closed at 1.2123.

The Bank of England, in its latest monetary policy meeting, decided to leave its key interest rate steady at 0.75%, as widely expected and indicated that the policymakers are in no rush for a near-term move in monetary policy. Further, the central bank slashed its growth forecast to 1.3% for both 2019 and 2020 from 1.5% and 1.6%, respectively, citing concerns over global economic slowdown.

In economic news, UK’s manufacturing PMI remained steady at a 6.5-year low level of 48.0 in July, defying market expectations for a drop to a a level of 47.6.

In the Asian session, at GMT0300, the pair is trading at 1.2106, with the GBP trading 0.14% lower against the USD from yesterday’s close.

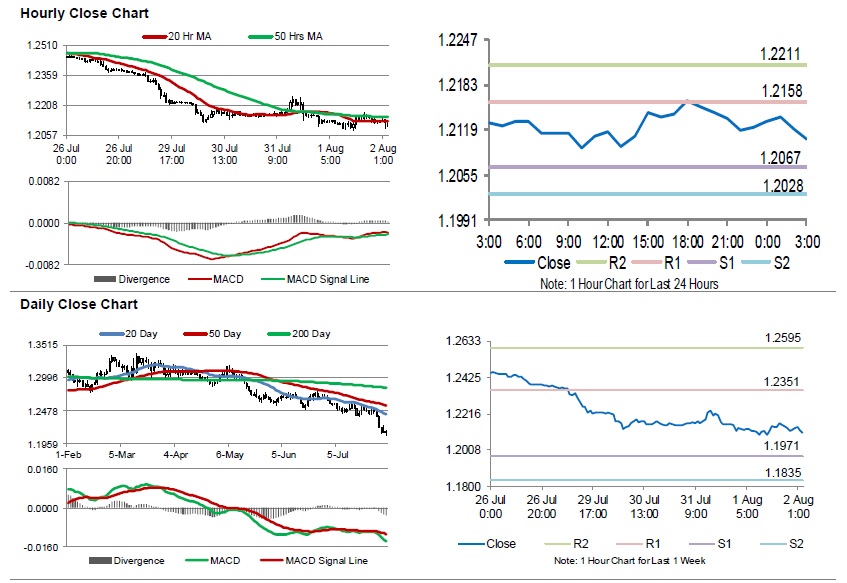

The pair is expected to find support at 1.2067, and a fall through could take it to the next support level of 1.2028. The pair is expected to find its first resistance at 1.2158, and a rise through could take it to the next resistance level of 1.2211.

Overnight data showed that UK’s Lloyds Bank business barometer remained unchanged at 13.0% in July.

Going ahead, traders would await UK’s RICS house price balance, Markit/CIPS services PMI, trade balance data, industrial production, gross domestic product and the Halifax house price index, all set to release next week.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.