For the 24 hours to 23:00 GMT, the GBP rose 0.57% against the USD and closed at 1.3247.

Yesterday, the Bank of England (BoE), at its June monetary policy meeting, opted to keep its key interest rates unchanged at 0.50%, in a split vote while all nine officials voted to maintain its asset purchase facility at £435.0 billion. Meanwhile, the Bank of England’s Chief Economist, Andy Haldane unexpectedly supported the hawks calling for an immediate interest-rate increase, defying the majority of policymakers who voted to keep the rate unchanged. The minutes of the meeting revealed that policymakers expect that any future increases in the rate are likely to be at a gradual pace and to a limited extent.

Data released showed that UK’s public sector net borrowing has recorded a deficit of £3.4 billion in May, while markets had envisaged for a deficit of £5.0 billion. In the previous month public sector borrowings registered a revised deficit of £5.3 billion.

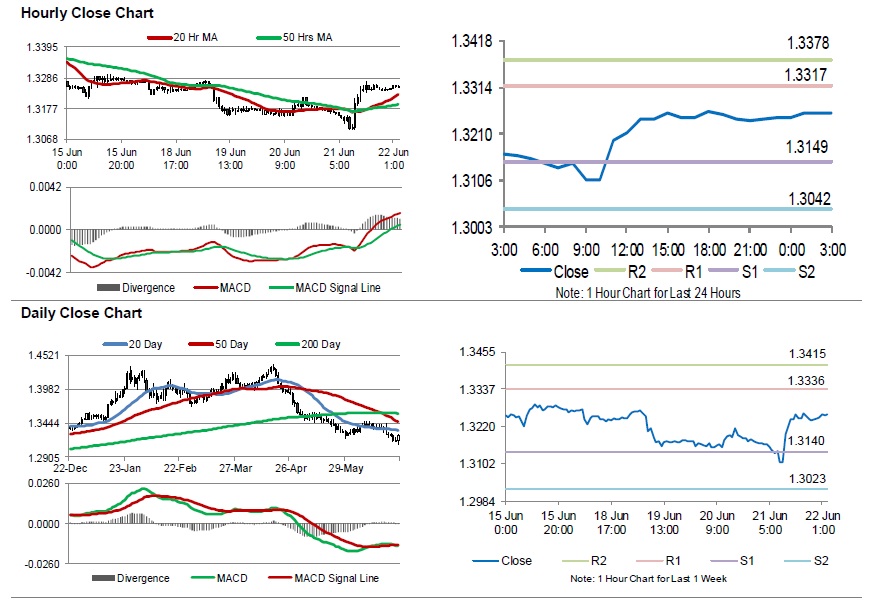

In the Asian session, at GMT0300, the pair is trading at 1.3257, with the GBP trading 0.08% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.3149, and a fall through could take it to the next support level of 1.3042. The pair is expected to find its first resistance at 1.3317, and a rise through could take it to the next resistance level of 1.3378.

Going forward, investors would await Britain’s final GDP and consumer confidence data, slated to release next week.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.