For the 24 hours to 23:00 GMT, the GBP rose 0.19% against the USD and closed at 1.3923, after the Bank of England (BoE) lifted UK’s economic growth forecasts and hinted at rapid monetary policy tightening.

The BoE, at its February monetary policy meeting, opted to keep the benchmark interest rate steady at 0.50%, as widely expected. In an accompanying statement, the central bank indicated that borrowing costs could rise sooner than expected and by a somewhat greater degree in order to prevent the Brexit-weakened economy from overheating. In its quarterly inflation report, the BoE nudged up Britain’s economic growth outlook to 1.80% for this year, up from its prior estimate of 1.60%, stating that UK trade would benefit from a strong global upswing. Additionally, growth estimate for 2019 was revised up 0.10% to 1.80%. Meanwhile, the central bank projected that annual inflation rate would hit 2.40% in 2018 before slowing to 2.20% next year.

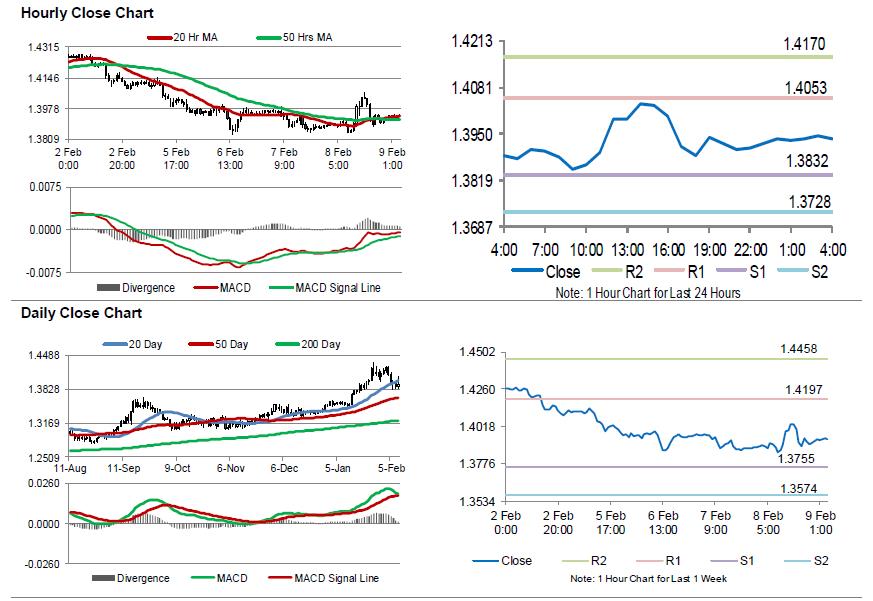

In the Asian session, at GMT0400, the pair is trading at 1.3935, with the GBP trading 0.09% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.3832, and a fall through could take it to the next support level of 1.3728. The pair is expected to find its first resistance at 1.4053, and a rise through could take it to the next resistance level of 1.4170.

Moving ahead, all eyes would be on UK’s industrial as well as manufacturing production, total trade balance and construction output data, all for December, slated to release in a few hours. Moreover, the NIESR GDP estimate for the three months ended January 2018, set to release later today, will also be on investors’ radar.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.