For the 24 hours to 23:00 GMT, GBP fell 0.23% against the USD and closed at 1.6783, after the minutes from the Bank of England’s April 9 policy meeting highlighted policymaker’s dissent over the amount of slack in the UK economy and over the medium-term inflation outlook. However, the minutes also showed that the UK central bank believed that economic recovery in the nation is gaining momentum and that it expects the economy to grow by 1% in the first three months of this year, slightly above its earlier growth forecast of 0.9%. However, the British Pound found some support after data revealed that UK’s budget deficit in the 12 months to March shrank to its lowest since the financial crisis while the nation’s public sector net borrowing recorded a deficit of £4.9 billion in March. Separately, the Confederation of British Industry (CBI), in its April quarterly industrial trends survey showed that the total new orders balance rose to 21 from 13 in January, and the domestic new orders balance climbed to 17 from 11, both hitting their highest levels since April 1995. In the single month of April, however, the new orders balance dipped to a reading of -1 from a level of 6 in March.

In the Asian session, at GMT0300, the pair is trading at 1.6786, with the GBP trading tad higher from yesterday’s close.

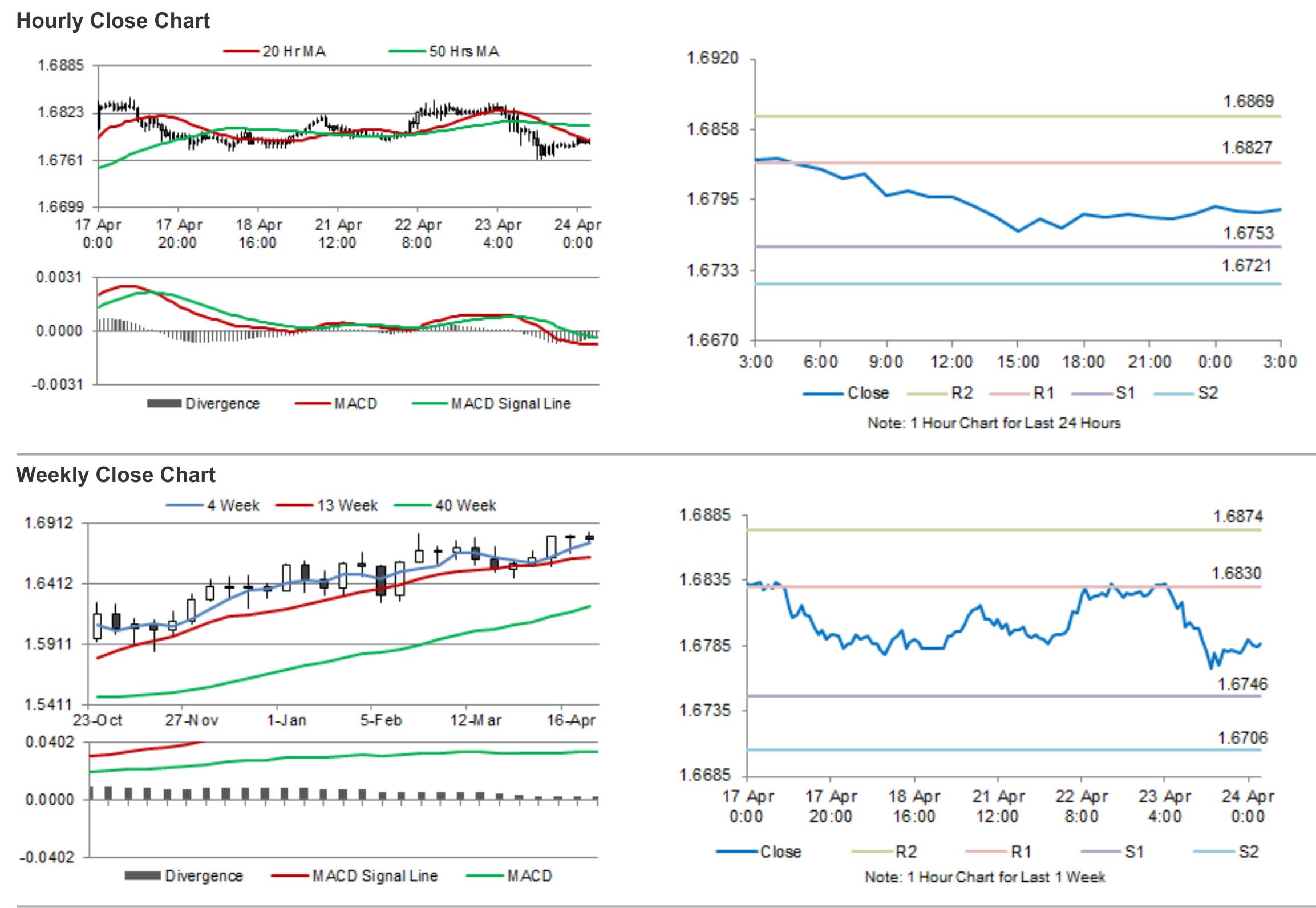

The pair is expected to find support at 1.6753, and a fall through could take it to the next support level of 1.6721. The pair is expected to find its first resistance at 1.6827, and a rise through could take it to the next resistance level of 1.6869.

Market participants are expected to keep a tab on CBI distributive trades survey’s data, slated for release later today.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.