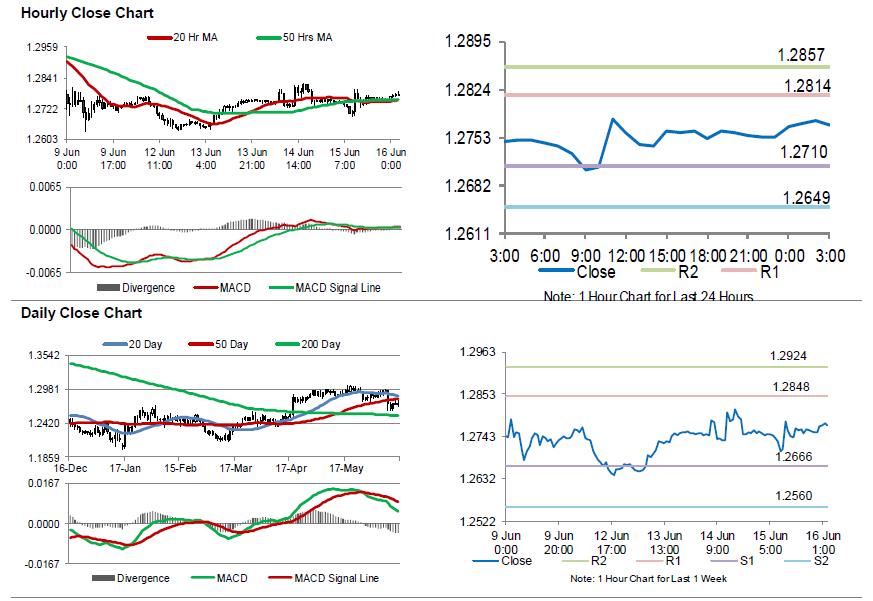

For the 24 hours to 23:00 GMT, the GBP slightly declined against the USD and closed at 1.2754.

Yesterday, the Bank of England (BoE), in a widely-expected move, opted to leave the key interest rate steady at 0.25% and the bond purchase programme remains unchanged at £435 billion, but surprised investors as three board members voted in favour of an immediate interest rate hike, swayed by fears of rising inflation. Minutes of the meeting disclosed that policy makers now expect inflation could overshoot the 2.0% target by more than previously thought. Further, it noted that officials judge the robust British labour market as a sign that rates may need to rise sooner than expected.

On the data front, Britain’s retail sales slid 1.2% on a monthly basis in May, higher than market expectations for a fall of 0.8%, intensifying worries about a slowdown in consumer spending as households remain grappled with rising inflation and meagre wage growth. In the prior month, retail sales had recorded a revised rise of 2.5%.

In the Asian session, at GMT0300, the pair is trading at 1.2772, with the GBP trading 0.14% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2710, and a fall through could take it to the next support level of 1.2649. The pair is expected to find its first resistance at 1.2814, and a rise through could take it to the next resistance level of 1.2857.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.