For the 24 hours to 23:00 GMT, the GBP declined 0.84% against the USD and closed at 1.3018, despite the Bank of England’s (BoE) rate hike decision.

Data indicated that, UK’s construction PMI unexpectedly rose to a level of 55.8 in July, notching its highest level since May 2017 and defying market expectations to ease to a level of 52.8. In the prior month, the PMI had recorded a reading of 53.1.

Separately, the BoE, at its August monetary policy meeting, raised its key interest to 0.75%, in an effort to bring back inflation to its targeted level of 2.0% and maintained the quantitative easing at £435.0 billion. The bank reiterated its view that any future interest rate hikes would be gradual and limited.

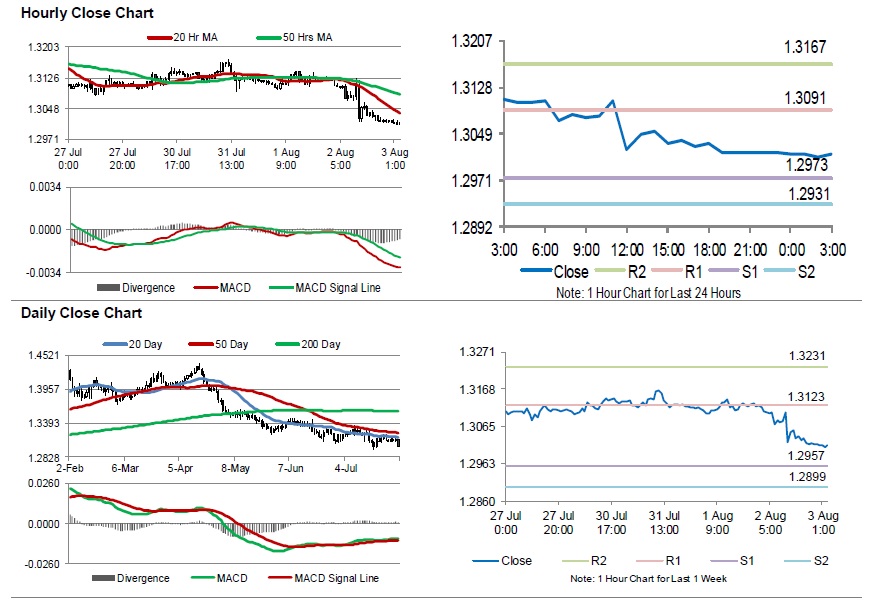

In the Asian session, at GMT0300, the pair is trading at 1.3015, with the GBP trading a tad lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2973, and a fall through could take it to the next support level of 1.2931. The pair is expected to find its first resistance at 1.3091, and a rise through could take it to the next resistance level of 1.3167.

Trading trend in the pound will be determined by the release of UK’s Markit services PMI for July, scheduled to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.