For the 24 hours to 23:00 GMT, the GBP rose 0.39% against the USD and closed at 1.2941, after the Bank of England (BoE) member, Ian McCafferty, struck a hawkish tone on monetary policy.

The BoE rate-setter, Ian McCafferty, stated that it is appropriate for the BoE to consider tapering its £453.0 billion asset purchase programme sooner rather than later.

Separately, the BoE’s credit conditions survey report revealed that availability of unsecured credit to households had decreased in the previous three months and banks are expected to further tighten the screw on consumer credit over the coming quarter as the outlook for household finances darkens amid uncertainty over Britain’s economic prospects.

In the Asian session, at GMT0300, the pair is trading at 1.2944, with the GBP trading a tad higher from yesterday’s close.

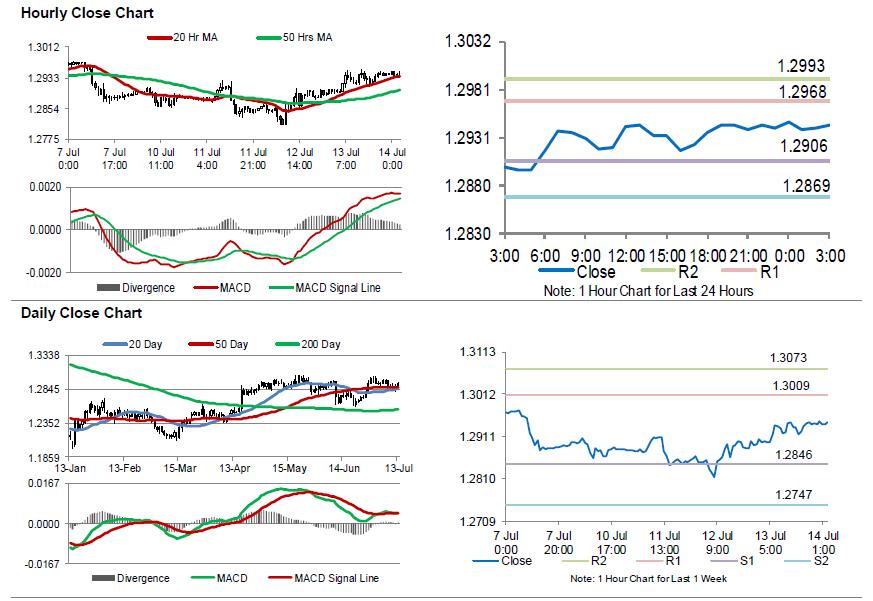

The pair is expected to find support at 1.2906, and a fall through could take it to the next support level of 1.2869. The pair is expected to find its first resistance at 1.2968, and a rise through could take it to the next resistance level of 1.2993.

With no economic releases in the UK today, investors await Britain’s crucial inflation and retail sales data, slated to release next week.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.