For the 24 hours to 23:00 GMT, the GBP rose 1.42% against the USD and closed at 1.3403, after the Bank of England (BoE) struck a hawkish tone at its latest monetary policy meeting.

The BoE, as widely expected, left the benchmark interest rate unchanged at a record low of 0.25%, with two of its nine policymakers voting for an immediate interest rate hike. Further, the central bank maintained its asset purchase facility at £435.0 billion. In a post meeting statement, the BoE Governor, Mark Carney, acknowledged that possibility of a rate hike has definitely increased and some “calibration” of monetary stimulus will be needed in the coming months. According to minutes of the meeting, majority of officials expressed the view that interest rates are likely to rise at a faster pace in the coming months, to combat inflation and as the economy continues to strengthen.

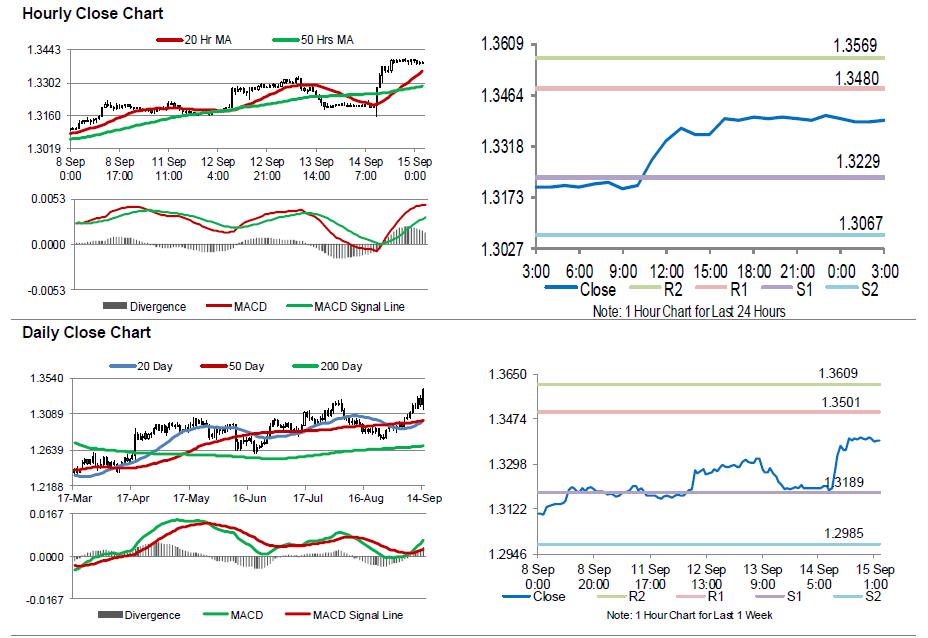

In the Asian session, at GMT0300, the pair is trading at 1.3392, with the GBP trading 0.08% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.3229, and a fall through could take it to the next support level of 1.3067. The pair is expected to find its first resistance at 1.348, and a rise through could take it to the next resistance level of 1.3569.

Going ahead, traders will keep a close watch on the BoE’s quarterly bulleting report, scheduled to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.