For the 24 hours to 23:00 GMT, the GBP declined 1.04% against the USD and closed at 1.2526, after the Bank of England (BoE), in its latest monetary policy meeting, played down the possibility of interest rate hike in the near-term.

The BoE, in a widely expected move, kept the record low key interest rate steady at 0.25%, amid rising growth projections as the economy entered the year on a strong footing, withstanding the uncertainty stemming from ‘Brexit’ talks that is set to begin as soon as in March. Further, the central bank expects faster economic growth in the UK over the next few years than previously forecasted and also predicts annual inflation to overshoot its 2.0% target within months, driven by a weaker pound. The bank now expects economic growth of 2.0% this year, up from 1.4% estimated in November, while also raising growth-forecast for 2018 and 2019 to 1.6% and 1.7% respectively, from 1.5% and 1.6% in November.

Another economic data showed that UK’s construction PMI dropped to a five-month low level of 52.2 in January, surpassing market consensus for the PMI to fall to a level of 53.8 and compared to a reading of 54.2 in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.2520, with the GBP trading marginally lower against the USD from yesterday’s close.

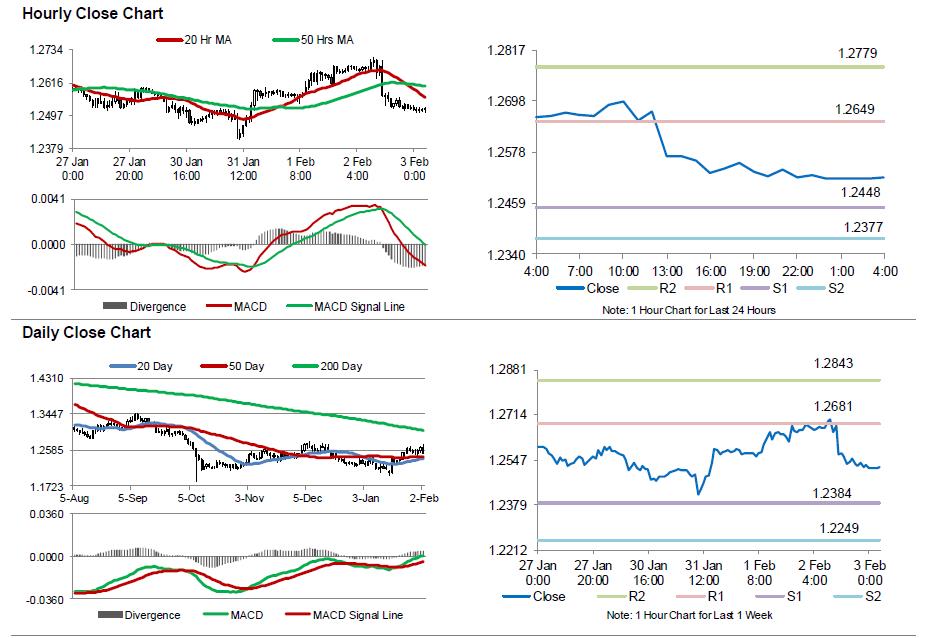

The pair is expected to find support at 1.2448, and a fall through could take it to the next support level of 1.2377. The pair is expected to find its first resistance at 1.2649, and a rise through could take it to the next resistance level of 1.2779.

Going ahead, market participants will focus on UK’s Markit services PMI for January, scheduled to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.