For the 24 hours to 23:00 GMT, the GBP declined 0.80% against the USD and closed at 1.3118.

The Bank of England (BOE), in its Financial Stability Report (FSR), cautioned over the risks posed by Brexit to the UK financial system. Meanwhile, the BoE Governor, Mark Carney, warned that rising protectionism could hurt global growth. Further, he stated that the British government had committed to a temporary permissions regime from March 2019 onwards, however, the EU has not done enough to ensure financial stability in case of hard Brexit scenario.

Separately, UK’s Nationwide’s seasonally adjusted house prices rebounded by 0.5% on a monthly basis in June, compared to a fall of 0.2% in the prior month. Markets had envisaged the house prices to rise 0.2%.

In the Asian session, at GMT0300, the pair is trading at 1.3119, with the GBP trading a tad higher against the USD from yesterday’s close.

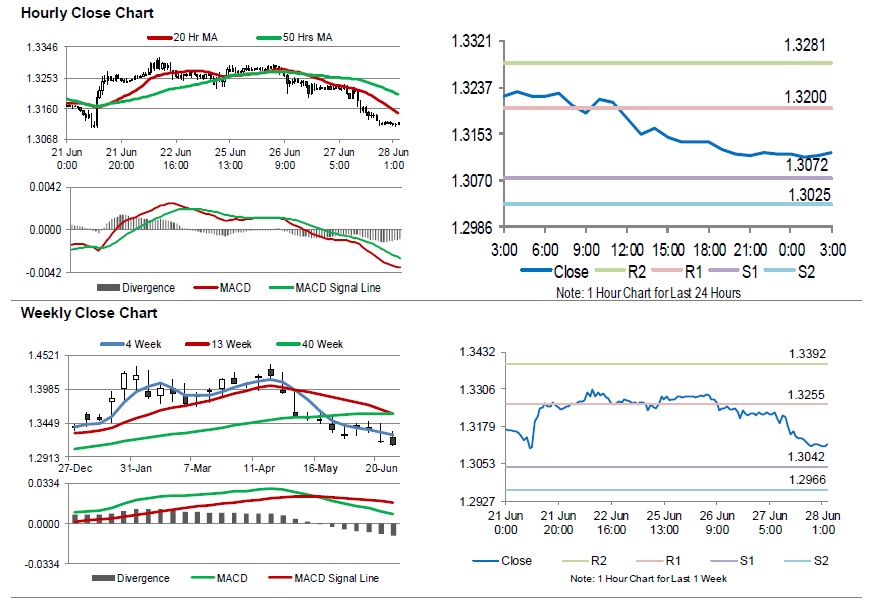

The pair is expected to find support at 1.3072, and a fall through could take it to the next support level of 1.3025. The pair is expected to find its first resistance at 1.3200, and a rise through could take it to the next resistance level of 1.3281.

Looking forward, traders will keep an eye on UK’s Gfk consumer confidence and Lloyds business barometer, both for June, scheduled to release overnight.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.