For the 24 hours to 23:00 GMT, the GBP rose 0.96% against the USD and closed at 1.2477, after data showed that British annual inflation advanced at the fastest pace in more than three years in February, breaching the Bank of England’s 2.0% target.

UK’s consumer price index (CPI) jumped 2.3% YoY in February, accelerating to its highest level since September 2013 amid a sharp drop in the pound and rising food and fuel prices, thus piling pressure on the Bank of England to raise interest rates sooner than estimated. The CPI had registered an advance of 1.8% in the prior month, while markets anticipated for it to rise 2.1%. On the other hand, the nation’s public sector net borrowing posted a less-than-expected deficit of £1.1 billion in February, as compared to a revised surplus of £11.7 billion in the previous month, whereas investors had envisaged for a deficit of £2.8 billion.

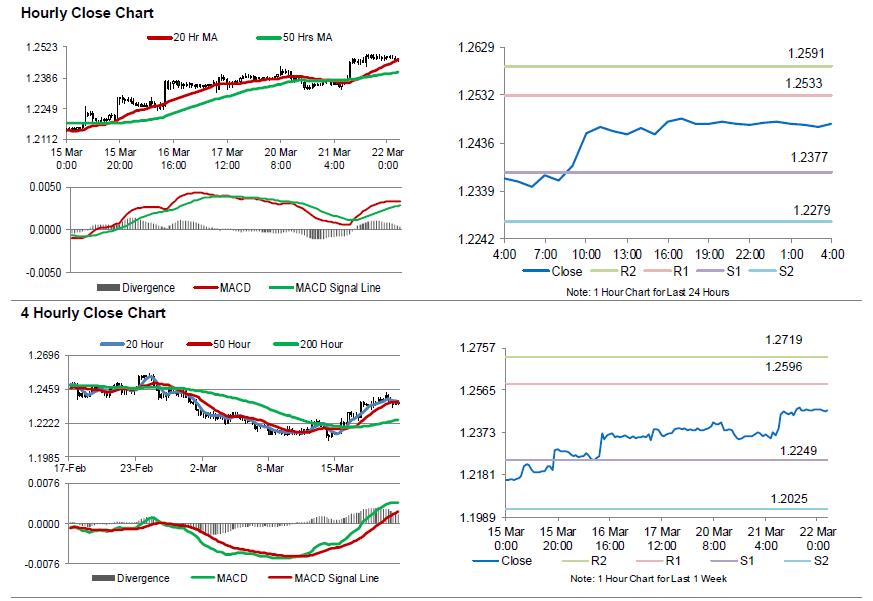

In the Asian session, at GMT0400, the pair is trading at 1.2474, with the GBP trading slightly lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2377, and a fall through could take it to the next support level of 1.2279. The pair is expected to find its first resistance at 1.2533, and a rise through could take it to the next resistance level of 1.2591.

In absence of any economic releases in the UK today, investors will focus on global macroeconomic events for further direction.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.