For the 24 hours to 23:00 GMT, the GBP rose 0.24% against the USD and closed at 1.3354, in the wake of a report which revealed that UK and the European Union (EU) have agreed a deal over Britain’s Brexit divorce bill, which could unlock vital trade talks next month.

Meanwhile, the Bank of England (BoE) Governor, Mark Carney stated that leading financial institutions in Britain could cope up and even support Britain through a “disorderly” Brexit. However, Carney stressed that this would be “painful” as it would hamper households and businesses and hurt the nation’s economic growth.

Separately, the OECD, in its latest global outlook, warned that the UK economy would continue to slow in 2018 and 2019, due to heightened uncertainty around Brexit and the impact of higher inflation on households. Economic growth in Britain is expected to grow 1.5% in 2017, before slipping down to 1.2% in 2018 and 1.1% in 2019.

In the Asian session, at GMT0400, the pair is trading at 1.3361, with the GBP trading a tad higher against the USD from yesterday’s close.

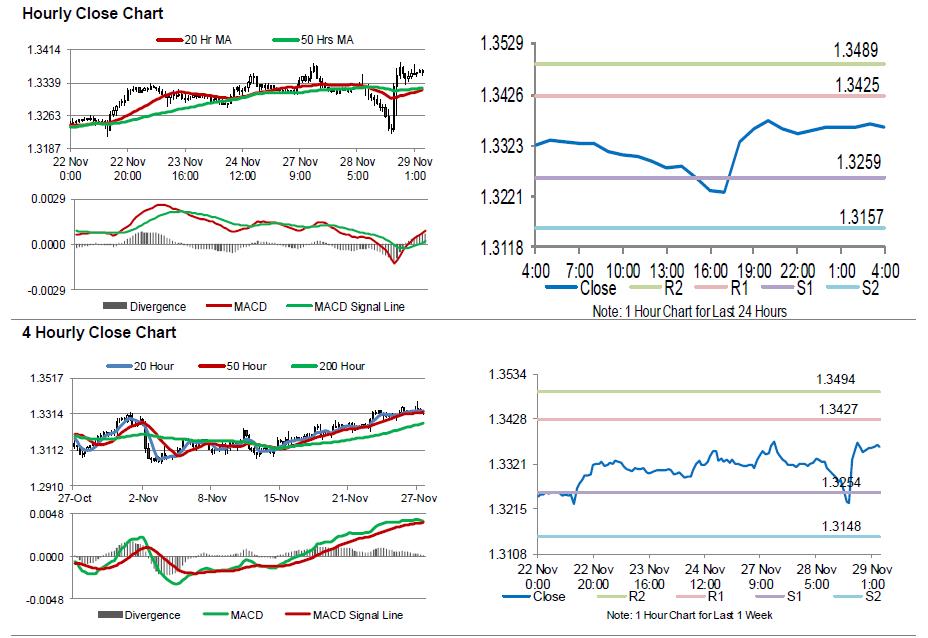

The pair is expected to find support at 1.3259, and a fall through could take it to the next support level of 1.3157. The pair is expected to find its first resistance at 1.3425, and a rise through could take it to the next resistance level of 1.3489.

Ahead in the day, market participants would look forward to UK’s net consumer credit and mortgage approvals data, both for October, slated to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.