For the 24 hours to 23:00 GMT, the GBP slightly declined against the USD and closed at 1.3506.

On the economic front, data showed that UK’s retail sales jumped 1.0% MoM and surged to a 4-month high in August, suggesting a solid consumer spending and brightening chances of the Bank of England hiking interest rates in the near future. In the prior month, retail sales had risen by a revised 0.6%, while markets had anticipated for a gain of 0.2%.

In the Asian session, at GMT0300, the pair is trading at 1.3495, with the GBP trading 0.08% lower from yesterday’s close.

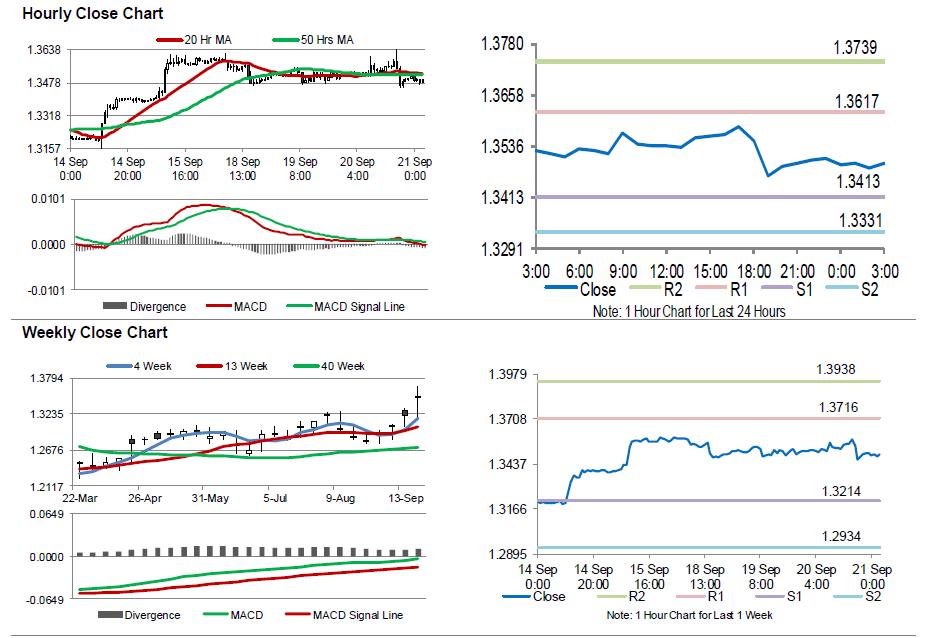

The pair is expected to find support at 1.3413, and a fall through could take it to the next support level of 1.3331. The pair is expected to find its first resistance at 1.3617, and a rise through could take it to the next resistance level of 1.3739.

Moving ahead, UK’s BBA mortgage approvals and public sector net borrowing data, both for August, slated to release in a few hours, will keep investors on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.