For the 24 hours to 23:00 GMT, the GBP rose 0.54% against the USD and closed at 1.2961, on the back of upbeat jobs data.

On macro front, data showed that UK’s ILO unemployment rate unexpectedly dropped to 4.0% in the September-November 2018 period, compared to a reading of 4.1% in the August-October 2018 period. Market participants had anticipated the ILO unemployment rate to record a steady reading. Additionally, average earnings including bonus rose 3.4% on an annual basis in the September-November 2018 period, more than market expectations and compared to a rise of 3.3% in the August-October 2018 period. Meanwhile, the nation’s public sector net borrowing deficit narrowed to a level of £2.1 billion in December, from a revised deficit of £6.3 billion in the previous month.

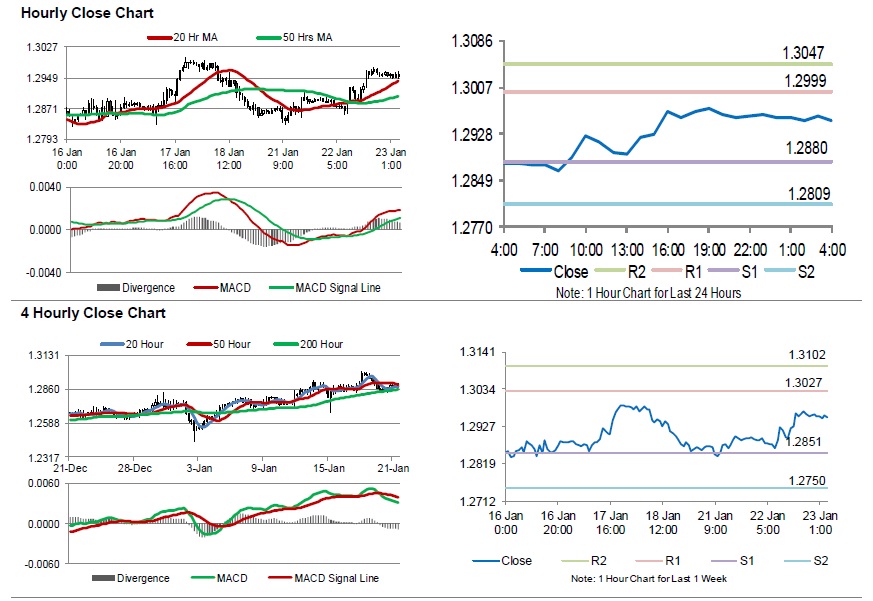

In the Asian session, at GMT0400, the pair is trading at 1.2952, with the GBP trading 0.07% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2880, and a fall through could take it to the next support level of 1.2809. The pair is expected to find its first resistance at 1.2999, and a rise through could take it to the next resistance level of 1.3047.

Moving ahead, traders would await UK’s CBI total trends orders for January, set to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.