For the 24 hours to 23:00 GMT, the GBP declined 0.17% against the USD and closed at 1.3182.

As per the Bank of England’s (BoE) Credit Conditions survey, household demand for secured lending for re-mortgaging increased in the second quarter. Further, it indicated that demand for unsecured credit is set to increase, while the availability is expected to drop slightly in the third quarter of 2018.

In the Asian session, at GMT0300, the pair is trading at 1.3181, with the GBP trading marginally lower against the USD from yesterday’s close.

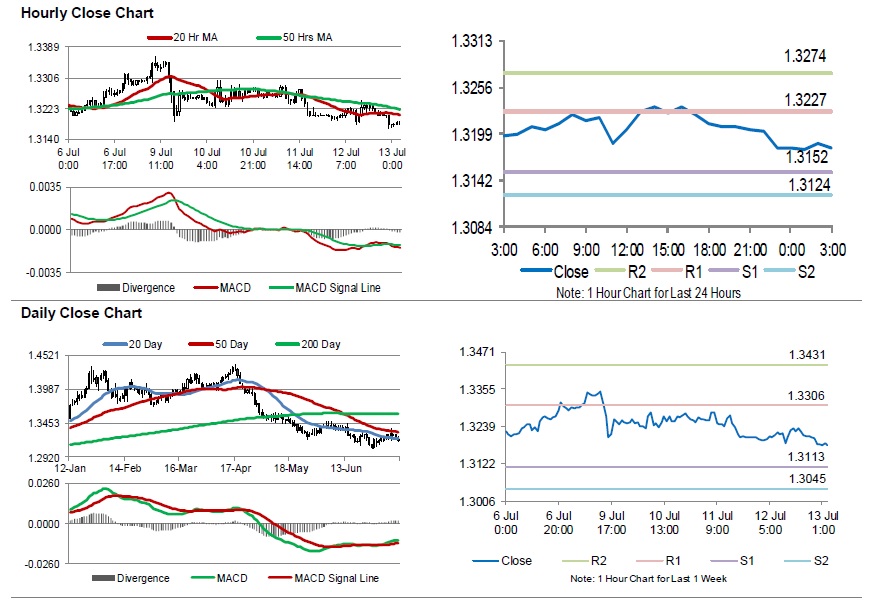

The pair is expected to find support at 1.3152, and a fall through could take it to the next support level of 1.3124. The pair is expected to find its first resistance at 1.3227, and a rise through could take it to the next resistance level of 1.3274.

Amid a lack of macroeconomic releases in the UK today, investor sentiment would be determined by global macroeconomic factors.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.