For the 24 hours to 23:00 GMT, the GBP declined 1.33% against the USD and closed at 1.2913, amid fears that the Brexit transition period could finish without a trade deal being agreed between the UK and the EU.

In the Asian session, at GMT0400, the pair is trading at 1.2916, with the GBP trading slightly higher against the USD from yesterday’s close.

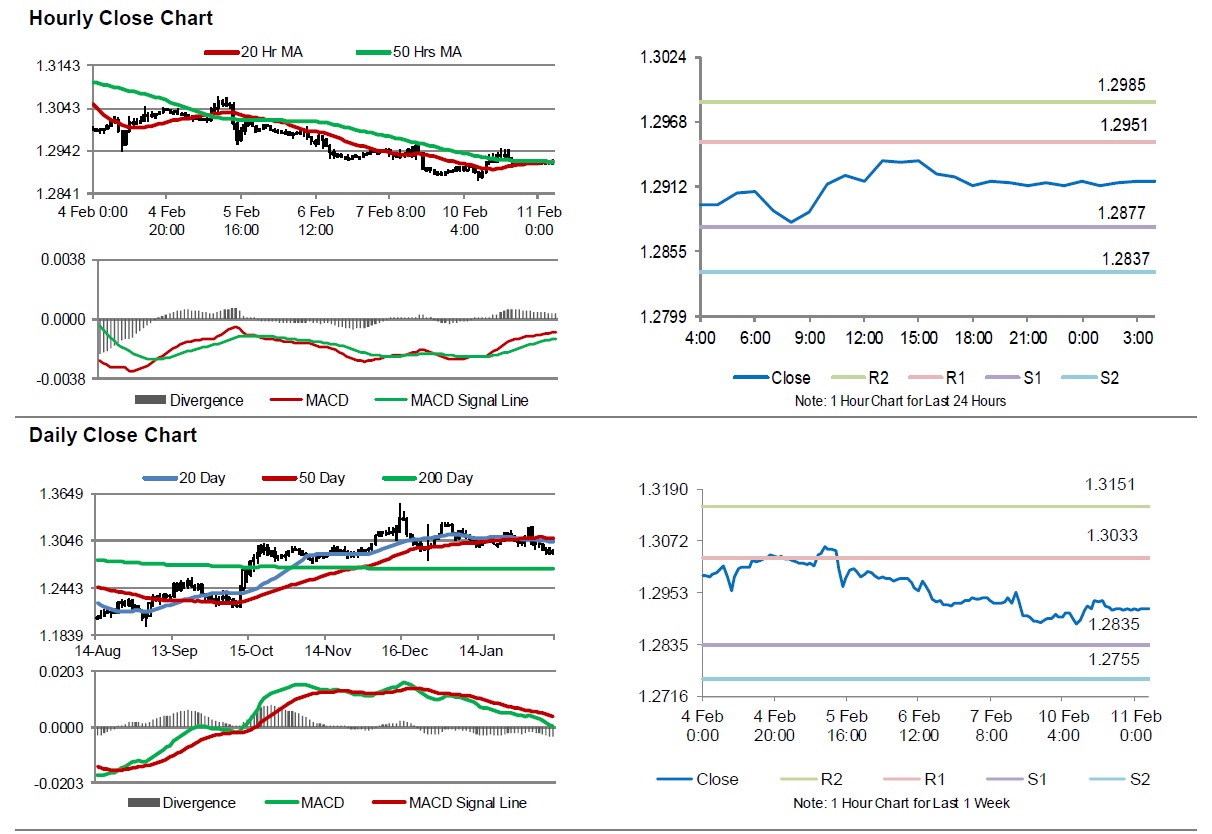

The pair is expected to find support at 1.2877, and a fall through could take it to the next support level of 1.2837. The pair is expected to find its first resistance at 1.2951, and a rise through could take it to the next resistance level of 1.2985.

Overnight data revealed that UK’s BRC like-for-like retail sales across all sectors remained flat on an annual basis in January. Retail sales across all sectors had recorded a rise of 1.7% in the previous month.

Moving ahead, all eyes would be on the UK industrial as well as manufacturing production, gross domestic product (GDP), total trade balance and construction output data, all for December, slated to release in a few hours. Moreover, the NIESR GDP estimate for the three months ended January 2020 and GDP for 4Q19, set to release later today, will also be on investors’ radar.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.