For the 24 hours to 23:00 GMT, the GBP traded marginally higher against the USD and closed at 1.5708.

In economic news, the UK’s BBA mortgage approvals dropped more than expected to a 17-month low of 37.1 K in October, against market expectations of a fall to a level of 38.50 K and compared to a revised reading of 39.13 K registered in September, thus raising fears over the health of the nation’s housing sector.

Yesterday, the BoE Governor, Mark Carney, indicated that increase in the UK interest rates would be more gradual than assumed, arguing that the UK economy still “needs monetary stimulus”. He also cautioned that weakness in Euro-economy posed the biggest threat to the recovery of Britain’s economy.

Separately, leading think tanker, OECD forecasted that the UK economy would expand by 3% in 2014, notching the fastest growth among G-7 nations this year, while the country’s economy would slow down to 2.7% and 2.5% in 2015 and 2016 respectively. It also reported that the BoE should start raising its interest rates from its record-low level of 0.5%, in the middle of the next year.

In the Asian session, at GMT0400, the pair is trading at 1.5703, with the GBP trading marginally lower from yesterday’s close.

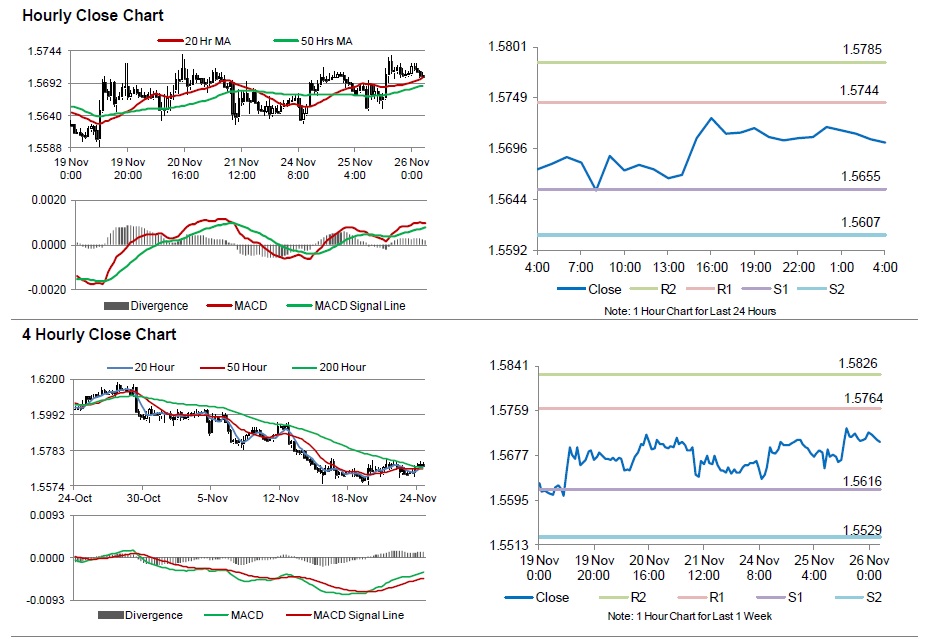

The pair is expected to find support at 1.5655, and a fall through could take it to the next support level of 1.5607. The pair is expected to find its first resistance at 1.5744, and a rise through could take it to the next resistance level of 1.5785.

Going forward, investor sentiment would be governed by the UK’s revised Q3 GDP data, set for release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.