For the 24 hours to 23:00 GMT, the GBP slightly declined against the USD and closed at 1.3432,

Yesterday, the Bank of England (BoE) policymaker, Gertjan Vlieghe stated that he expects interest rates to rise at a faster pace over the next three years. Separately, the BoE Governor, Mark Carney expressed confidence that the British economy would rebound from a lacklustre performance at the start of the year when it was hit by heavy snowstorms.

On the data front, Britain’s public sector net borrowing posted a less-than-anticipated deficit of £6.2 billion in April, following a revised surplus of £0.8 billion in the prior month. Market participants had envisaged the public sector net borrowing to record a deficit of £7.1 billion. Meanwhile, the nation’s CBI industrial trends total orders dropped to a level of -3.0 in May, compared to a level of 4.0 in the previous month, while markets were anticipating for a fall to a level of 2.0.

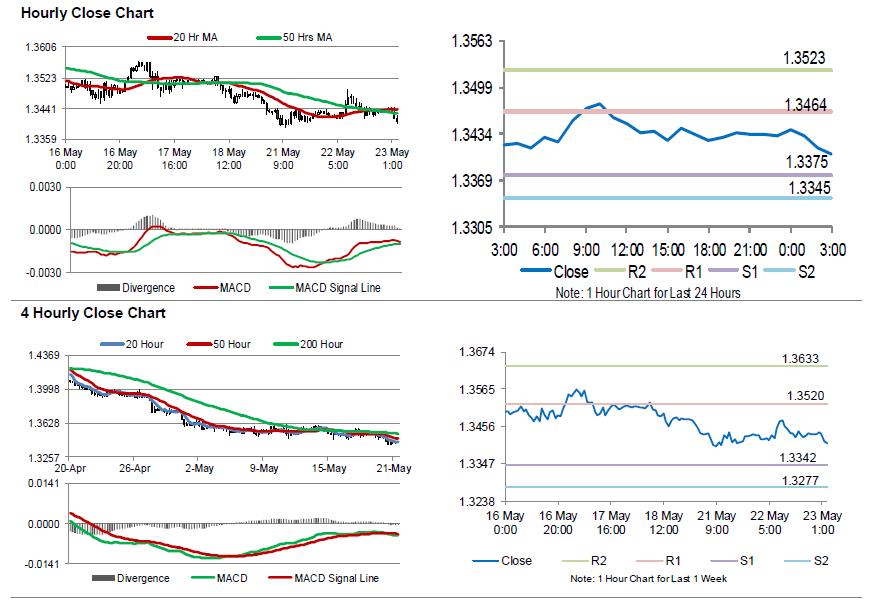

In the Asian session, at GMT0300, the pair is trading at 1.3406, with the GBP trading 0.19% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.3375, and a fall through could take it to the next support level of 1.3345. The pair is expected to find its first resistance at 1.3464, and a rise through could take it to the next resistance level of 1.3523.

Trading trend in the Pound today is expected to be determined by the release of UK’s crucial inflation figures for April, scheduled in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.