For the 24 hours to 23:00 GMT, the GBP declined 0.34% against the USD and closed at 1.3064 on Friday.

On Friday, Bank of England Governor, Mark Carney assured that the bank is prepared to face all potential outcomes of Brexit and the policy response will not be automatic. However, Carney warned that the impact of a no-deal Brexit could be as dangerous as the 2008 financial crisis and could worsen property markets and increase unemployment. Meanwhile, he forecasted a rebound of £16 billion in favour of the UK economy, provided Britain follows Theresa May’s Chequers Brexit proposal.

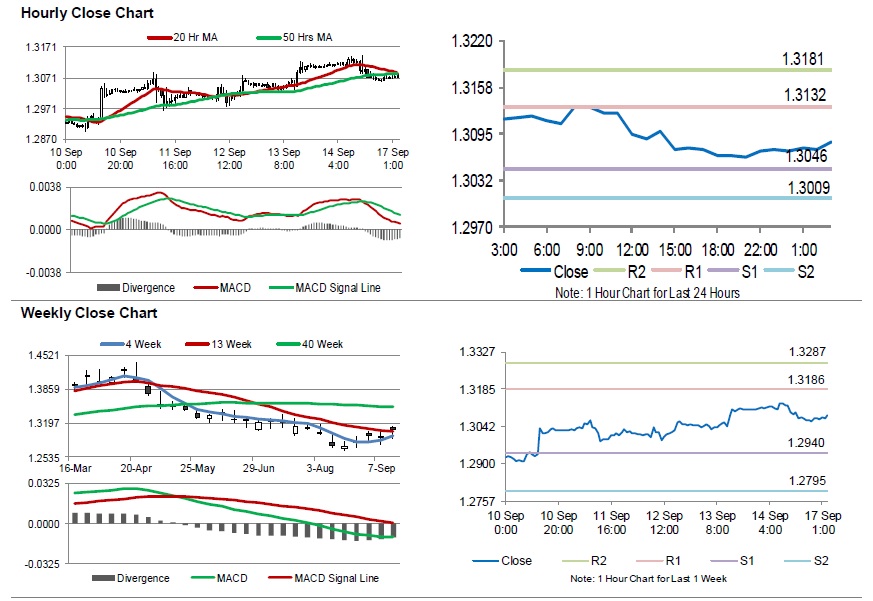

In the Asian session, at GMT0300, the pair is trading at 1.3084, with the GBP trading 0.15% higher against the USD from Friday’s close.

Overnight data showed that the Rightmove house price index rebounded 0.70% on a monthly basis in September. In the previous month, the index had registered a drop of 2.3%.

The pair is expected to find support at 1.3046, and a fall through could take it to the next support level of 1.3009. The pair is expected to find its first resistance at 1.3132, and a rise through could take it to the next resistance level of 1.3181.

With no macroeconomic releases in UK today, investors would look forward to global macroeconomic releases for further directions.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.