For the 24 hours to 23:00 GMT, the GBP rose 0.24% against the USD and closed at 1.2186 on Friday.

On Friday, the Bank of England (BoE), in its credit conditions survey report, found that demand for bank loans among small and medium-sized British firms declined significantly during the last three months of 2016 amid worries about Brexit. Further, the BoE noted that secured credit availability to households remained unchanged in three months to December, but is expected to increase slightly during the first quarter of 2017.

In the Asian session, at GMT0400, the pair is trading at 1.2027, with the GBP trading 1.3% lower against the USD from Friday’s close, as news that Britain’s Prime Minister, Theresa May, will signal plans to exit the European Union’s single market to regain control over Britain’s borders continued to weigh on investor sentiment.

Overnight data revealed that UK’s Rightmove house price index rebounded 0.4% on a monthly basis in January, following a drop of 2.1% in the prior month.

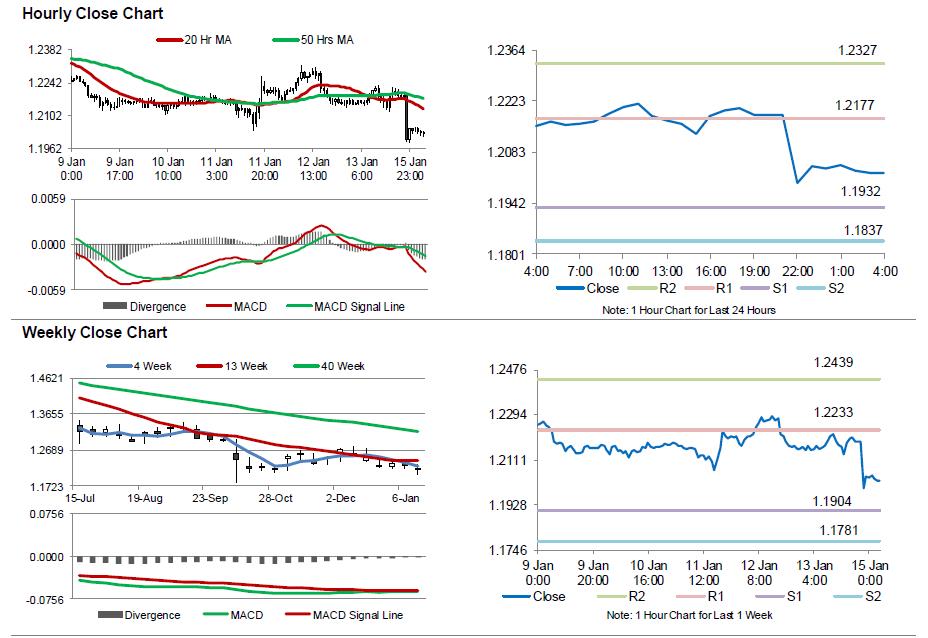

The pair is expected to find support at 1.1932, and a fall through could take it to the next support level of 1.1837. The pair is expected to find its first resistance at 1.2177, and a rise through could take it to the next resistance level of 1.2327.

Moving ahead, market participants will closely monitor comments from the BoE Governor, Mark Carney, scheduled to speak later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.