For the 24 hours to 23:00 GMT, the GBP declined 0.25% against the USD and closed at 1.3023 on Friday, after the British Parliament, for the third time, rejected Prime Minister Theresa May’s Brexit deal.

On the macro front, UK’s gross domestic product (GDP) rose 0.2% on a quarterly basis in the fourth quarter of 2018, in line with market forecast and confirming the preliminary print. The GDP had recorded a rise of 0.6% in the previous quarter. Additionally, Nationwide house price index climbed 0.7% on an annual basis in March, beating market expectations for a rise of 0.6% and notching its highest level in four months. The house price index had recorded a gain of 0.4% in the prior month. Further, net consumer credit recorded a rise of £1.1 billion in February, higher than market expectations for a rise of £0.9 billion. Net consumer credit had risen by a revised £1.2 billion in the previous month.

On the other hand, the nation’s mortgage approvals for house purchase fell to a level of 64.3K in February, more than market expectations for a fall to a level of 65.0K. Mortgage approvals had recorded a revised level of 66.7K in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.3030, with the GBP trading 0.05% higher against the USD from Friday’s close.

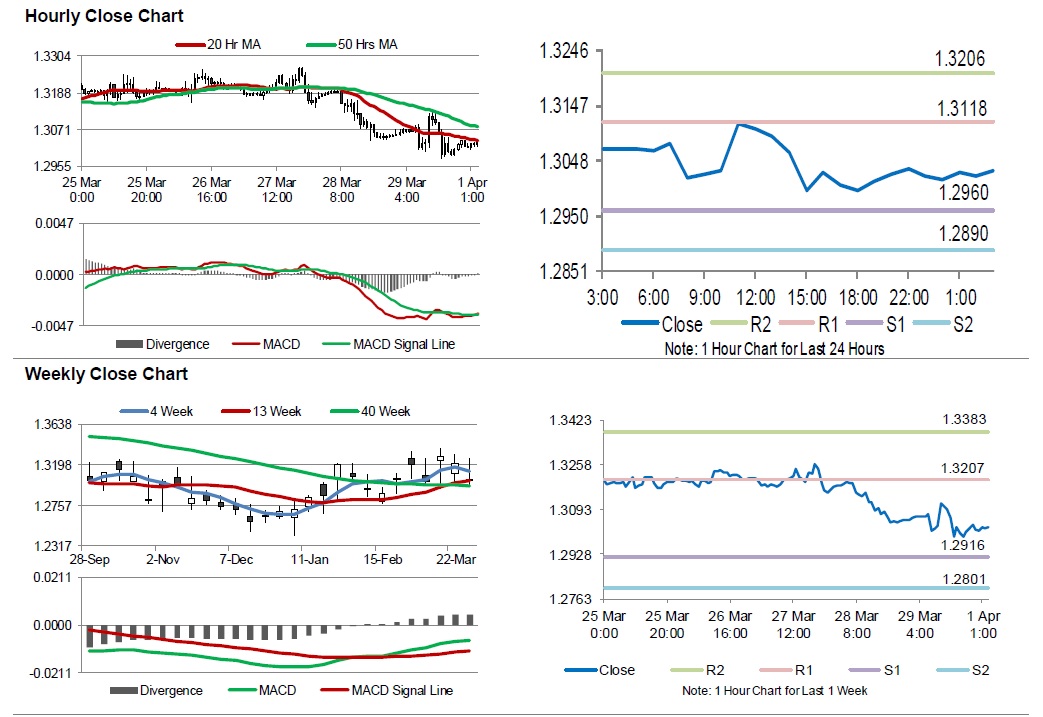

The pair is expected to find support at 1.2960, and a fall through could take it to the next support level of 1.2890. The pair is expected to find its first resistance at 1.3118, and a rise through could take it to the next resistance level of 1.3206.

Moving ahead, investors would keep a close watch on UK’s manufacturing PMI for March, slated to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.