For the 24 hours to 23:00 GMT, the GBP rose 1.76% against the USD and closed at 1.2998, on Brexit deal hopes and following hawkish comments from the Bank of England (BoE) Governor, Mark Carney.

In the economic news, UK’s manufacturing PMI eased to a level of 51.1 in October, more than market expectations for a drop to a level of 53.0. In the previous month, the PMI had registered a revised level of 53.6. Moreover, the nation’s seasonally adjusted Nationwide house prices index remained flat on a monthly basis in October, defying market expectations for an advance of 0.2%. The index had recorded a rise of 0.3% in the prior month.

The BoE, in its October monetary policy meeting, maintained its key interest rate at 0.75%, meeting market expectations and decided to maintain the quantitative easing through asset purchases at GBP435.00bn. Additionally, the central bank reiterated that any future rate hikes will be at a gradual pace and to a limited extent. However, officials cautioned that economic outlook of the country remains sensitive to the effects of Brexit.

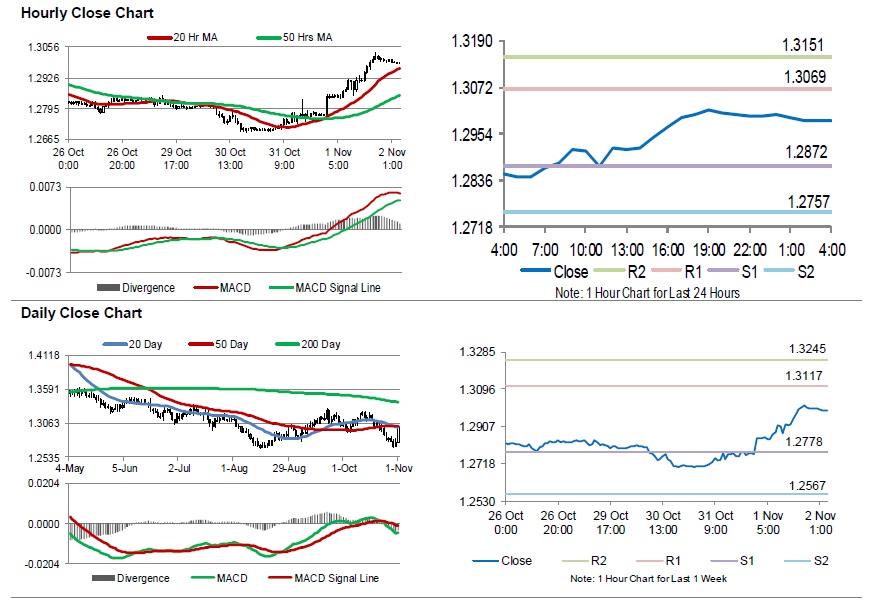

In the Asian session, at GMT0400, the pair is trading at 1.2988, with the GBP trading 0.08% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2872, and a fall through could take it to the next support level of 1.2757. The pair is expected to find its first resistance at 1.3069, and a rise through could take it to the next resistance level of 1.3151.

Moving forward, traders would await UK’s Markit construction PMI for October, scheduled to release later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.