For the 24 hours to 23:00 GMT, the GBP rose 0.15% against the USD and closed at 1.2950.

On the macro front, UK’s Halifax house price index advanced 0.8% on a yearly basis in the three months ended January 2019, falling short of market anticipation for a rise to a level of 1.5%. In the October-December 2018 period, the index had recorded a jump of 1.3%.

The Bank of England, in its latest monetary policy meeting, kept its interest rate steady at 0.75%, as widely expected. The central bank trimmed its GDP outlook to 1.2% from 1.7% in 2019 citing uncertainty over Brexit. Growth projections for 2020 was also lowered to 1.5%, while the growth outlook for 2021 was raised to 1.9%.

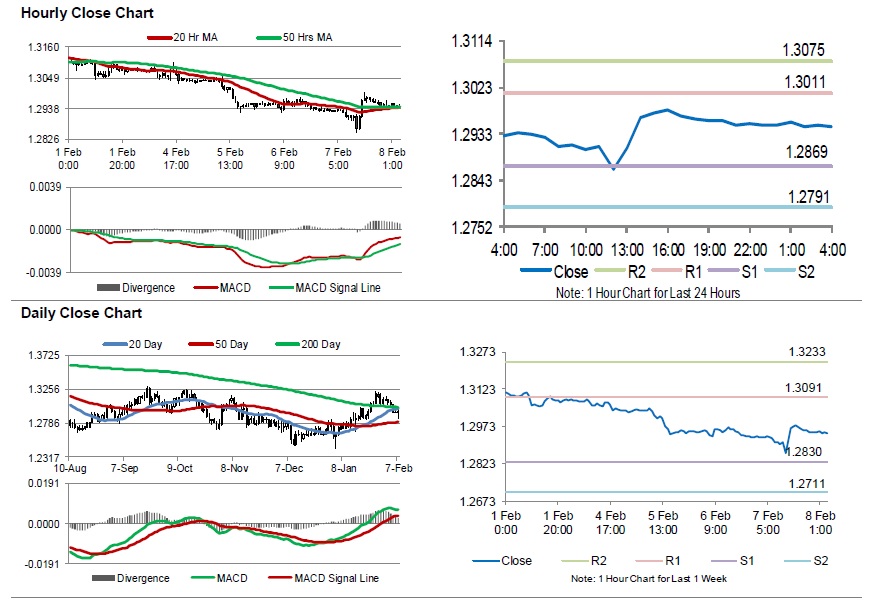

In the Asian session, at GMT0400, the pair is trading at 1.2948, with the GBP trading a tad lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2869, and a fall through could take it to the next support level of 1.2791. The pair is expected to find its first resistance at 1.3011, and a rise through could take it to the next resistance level of 1.3075.

Moving ahead, investors would closely monitor UK’s gross domestic product, trade balance data, industrial production and manufacturing production, slated to release next week.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.