For the 24 hours to 23:00 GMT, the GBP declined 0.43% against the USD and closed at 1.3192, following comments from the Bank of England (BoE) Governor.

The BoE Governor, Mark Carney, warned that “more likely than not”, inflation in Britain would peak above 3.0% in the coming months and reiterated that a rate hike might be appropriate in the coming months. Further, Carney also stressed the importance of avoiding a so-called hard Brexit and that a transition agreement is in everyone’s interests.

On the macro front, UK’s consumer price index (CPI) rose 3.0% on a yearly basis in September, meeting market expectations and jumping to a more than five-year high level, thus amplifying pressure on the BoE to raise interest rates in the near-term. The CPI had registered a rise of 2.9% in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.3196, with the GBP trading slightly higher against the USD from yesterday’s close.

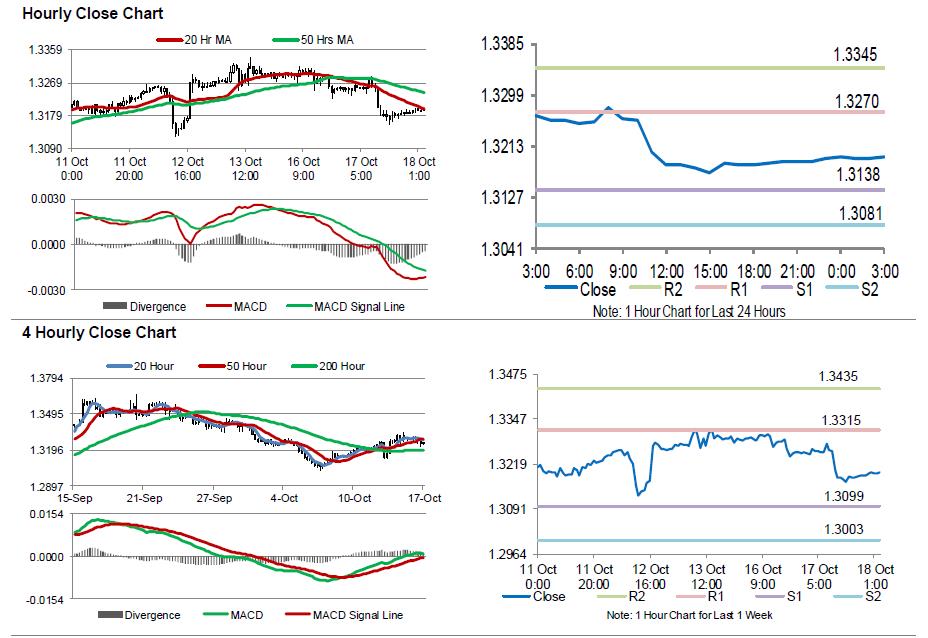

The pair is expected to find support at 1.3138, and a fall through could take it to the next support level of 1.3081. The pair is expected to find its first resistance at 1.3270, and a rise through could take it to the next resistance level of 1.3345.

Moving ahead, market participants would eye Britain’s ILO unemployment rate and average earnings for the three months to August, due to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.