For the 24 hours to 23:00 GMT, the GBP rose 0.96% against the USD and closed at 1.3202 on Friday, after UK’s economic growth was revised higher in the first quarter of 2018.

Data showed that the nation’s final gross domestic product (GDP) advanced 0.2% on a quarterly basis in the first three months of 2018, higher than market expectations. GDP had recorded a rise of 0.4% in the previous quarter. The preliminary figures had indicated an advance of 0.1%. Meanwhile, the nation’s net consumer credit expanded by £1.4 billion in May, falling short of market expectations for a gain of £1.5 billion. In the previous month, net consumer credit had advanced £1.8 billion.

Moreover, number of mortgage approvals for house purchases surprisingly jumped to a 4-month high level of 64.5K, compared to market expectations of a fall to a level of 62.3K. In the previous month, number of mortgage approvals had registered a revised level of 62.9K. Britain’s final total business investment rose of 2.0% on yearly basis in 1Q, in line with market expectations. In the prior quarter, total business investment had climbed by 2.6%.

In the Asian session, at GMT0300, the pair is trading at 1.3179, with the GBP trading 0.17% lower against the USD from Friday’s close.

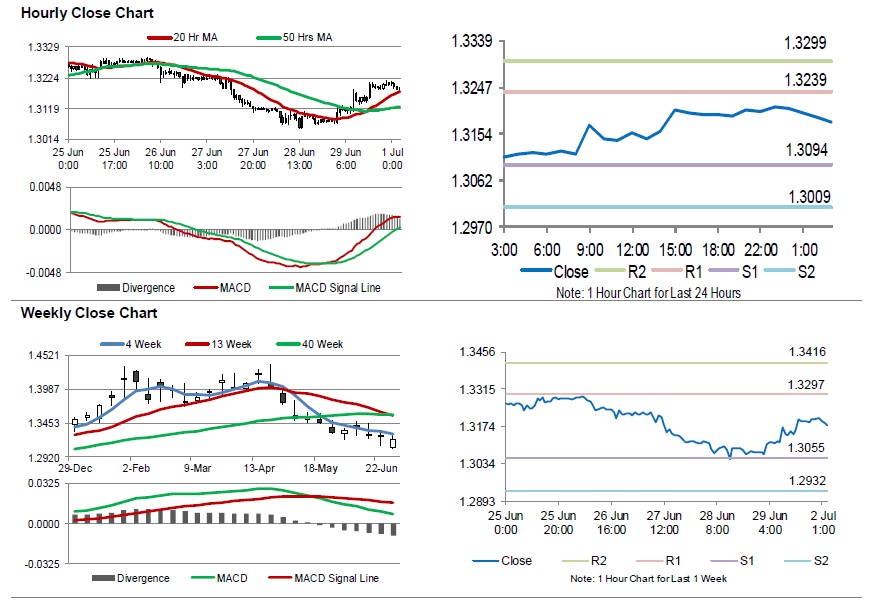

The pair is expected to find support at 1.3094, and a fall through could take it to the next support level of 1.3009. The pair is expected to find its first resistance at 1.3239, and a rise through could take it to the next resistance level of 1.3299.

Looking forward, traders will await the release of UK’s Markit manufacturing PMI for June, scheduled to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.