For the 24 hours to 23:00 GMT, the GBP fell 0.24% against the USD and closed at 1.4661.

In economic news, the second estimate of UK’s gross domestic product (GDP) advanced in line with market expectations by 0.4% QoQ in 1Q 2016 and compared to an advance of 0.6% in the prior quarter. The preliminary figures had also recorded a rise of 0.4%. On the other hand, the nation’s BBA mortgage approvals unexpectedly dropped to a level of 40.1K, compared to market expectations of a rise to a level of 44.7K and following a revised reading of 43.9K in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.4657, with the GBP trading marginally lower from yesterday’s close.

Overnight data showed that, Britain’s GfK consumer confidence index surprisingly edged up to a level of -1.0 in May, rising for the first time since January 2016. However, the index remained below zero, as the uncertainty surrounding next month’s referendum on the European Union membership weighed on consumer sentiment. Market expectation was for the index to further decline to a level of -4.0, after recording a reading of -3.0 in the previous month.

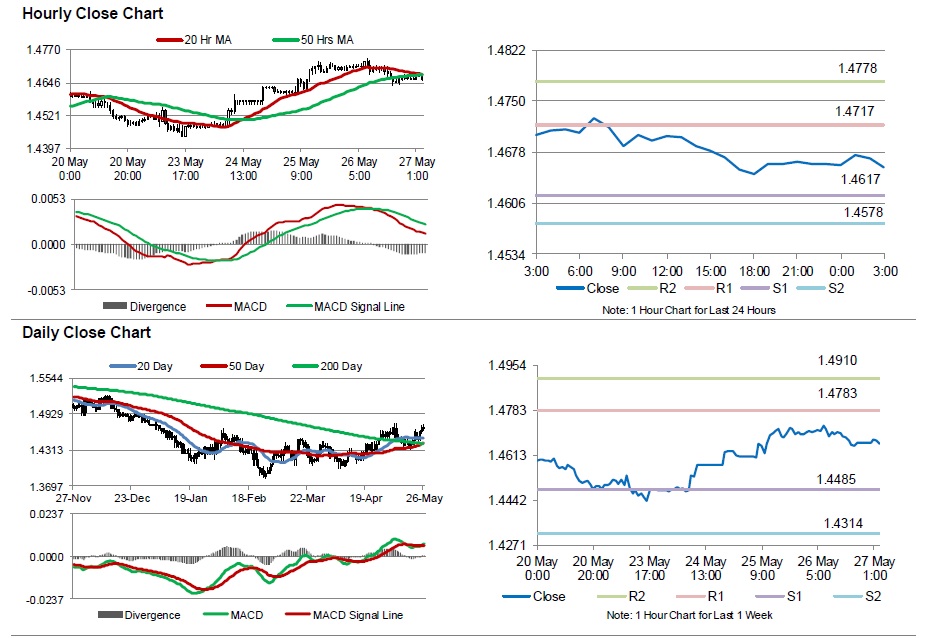

The pair is expected to find support at 1.4617, and a fall through could take it to the next support level of 1.4578. The pair is expected to find its first resistance at 1.4717, and a rise through could take it to the next resistance level of 1.4778.

With no economic releases in Britain today, investors will look forward to the nation’s consumer credit and mortgage approvals data, along with Markit manufacturing and services PMI data for May, all due next week.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.