For the 24 hours to 23:00 GMT, the GBP declined 0.40% against the USD and closed at 1.2597, after the Bank of England’s Governor, Mark Carney signalled that the economy could lose its momentum in case of a no-deal Brexit and ongoing global trade disputes resulting into possibilities of monetary policy easing in coming months.

In economic news, UK’s construction PMI unexpectedly declined to a decade low level of 43.1 in June, amid mounting Brexit uncertainties and defying market consensus for a gain to a level of 49.2. The PMI had recorded a reading of 48.6 in the previous month. Meanwhile, the nation’s seasonally adjusted Nationwide house price index rose 0.1% on a monthly basis in June, less than market expectations for a rise of 0.2%. In the prior month, index had registered a drop of 0.2%.

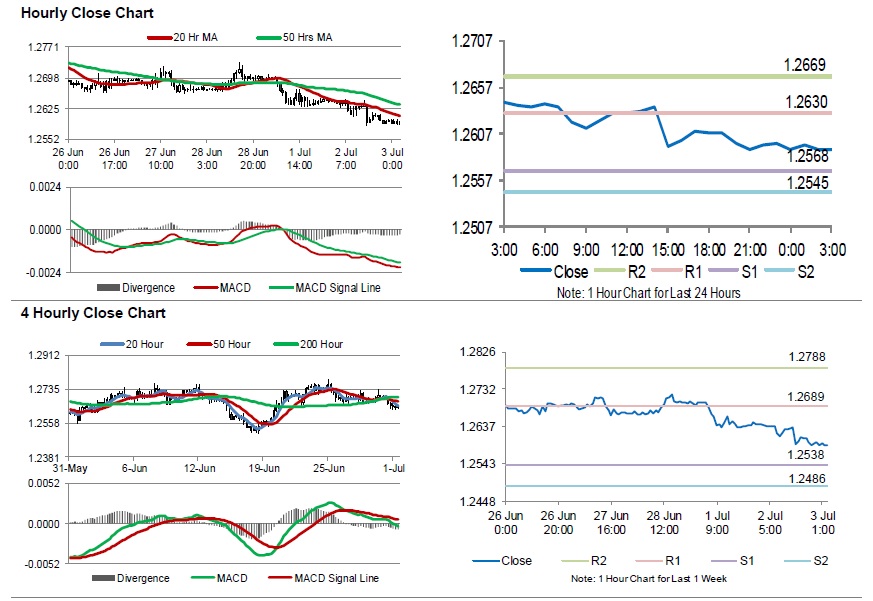

In the Asian session, at GMT0300, the pair is trading at 1.2591, with the GBP trading 0.05% lower against the USD from yesterday’s close.

Overnight data indicated that BRC shop price index fell 0.1% on a yearly basis in June, following an increase of 0.8% in the preceding month.

The pair is expected to find support at 1.2568, and a fall through could take it to the next support level of 1.2545. The pair is expected to find its first resistance at 1.2630, and a rise through could take it to the next resistance level of 1.2669.

Trading trend in the Sterling today is expected to be determined by UK’s Markit services PMI for June, slated to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.