For the 24 hours to 23:00 GMT, the GBP rose 0.13% against the USD and closed at 1.2915, after data indicated that annual inflation in the UK soared in April.

Data showed that Britain’s consumer price index (CPI) advanced more-than-anticipated by 2.7% on an annual basis in April, surging to its highest level since September 2013, thus posing a serious challenge to the nation’s households as wages fail to keep pace with rising inflation. Markets expected the CPI to rise 2.6%, after registering a gain of 2.3% in the previous month.

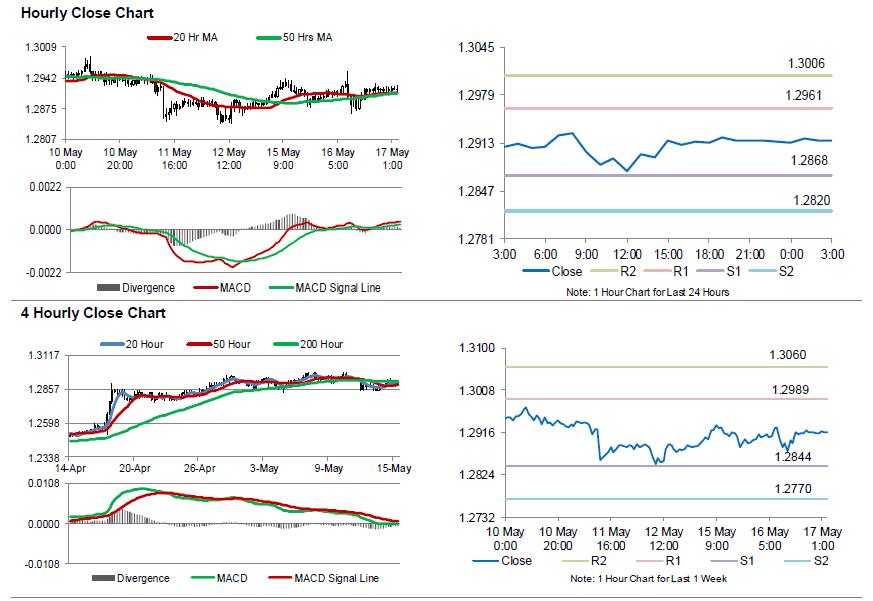

In the Asian session, at GMT0300, the pair is trading at 1.2917, with the GBP trading slightly higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2868, and a fall through could take it to the next support level of 1.2820. The pair is expected to find its first resistance at 1.2961, and a rise through could take it to the next resistance level of 1.3006.

Going ahead, UK’s ILO unemployment rate for the three months to March along with average earnings data, scheduled to release in a few hours, will keep investors on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.