For the 24 hours to 23:00 GMT, the GBP rose 0.27% against the USD and closed at 1.5126, after UK’s BBA mortgage approvals climbed in October from September.

Data showed that Britain’s BBA mortgage approvals advanced to a level of 45.4K in October, compared to a revised reading of 44.8K in the previous month.

Separately, in UK’s Autumn Statement, Chancellor of the Exchequer, George Osborne, left the UK GDP forecast for 2015 unchanged at 2.4%. Further, growth for the next two years was revised upwards from the Budget forecast to 2.4% in 2016 and to 2.5% in 2017. He further stated that, in the long term trend, growth is expected to return to 2.4% in 2018 and 2.3% in 2019-20. Also, the Office for Budget Responsibility (OBR) predicted that debt would fall this year and will continue to decline every year that follows. The Chancellor also raised his budget surplus target to £10.1 billion by the financial year 2019-20, slightly higher than a previous target announced in July and also abandoned a controversial plan to make big savings in one part of the welfare budget.

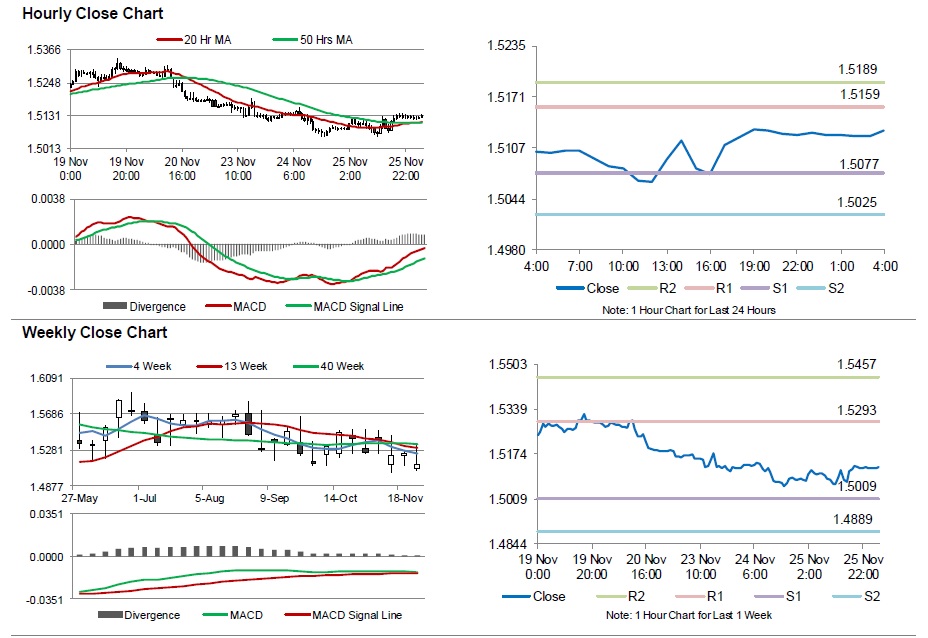

In the Asian session, at GMT0400, the pair is trading at 1.5128, with the GBP trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.5077, and a fall through could take it to the next support level of 1.5025. The pair is expected to find its first resistance at 1.5159, and a rise through could take it to the next resistance level of 1.5189.

Going ahead, market participants will look forward to UK’s financial stability report, scheduled to be released in a few hours, for further cues.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.