For the 24 hours to 23:00 GMT, the GBP marginally rose against the USD and closed at 1.3169, after UK’s ILO unemployment rate remained steady at a 42-year low of 4.3% in the three months to September, meeting market expectations. Further, the nation’s average earnings including bonus advanced more-than-anticipated by 2.2% in the July-September period, but remained firmly behind inflation, indicating that the squeeze on consumers may continue for some time. Average earnings including bonus had registered a revised gain of 2.3% in the June-August period, while markets were expecting for a rise of 2.1%.

However, the number of people employed in the nation unexpectedly fell by 14.0K in the July-September period, declining for the first time since October 2016. Markets were expecting employment to rise 52.0K, following an increase of 94.0K in the June-August 2017 period.

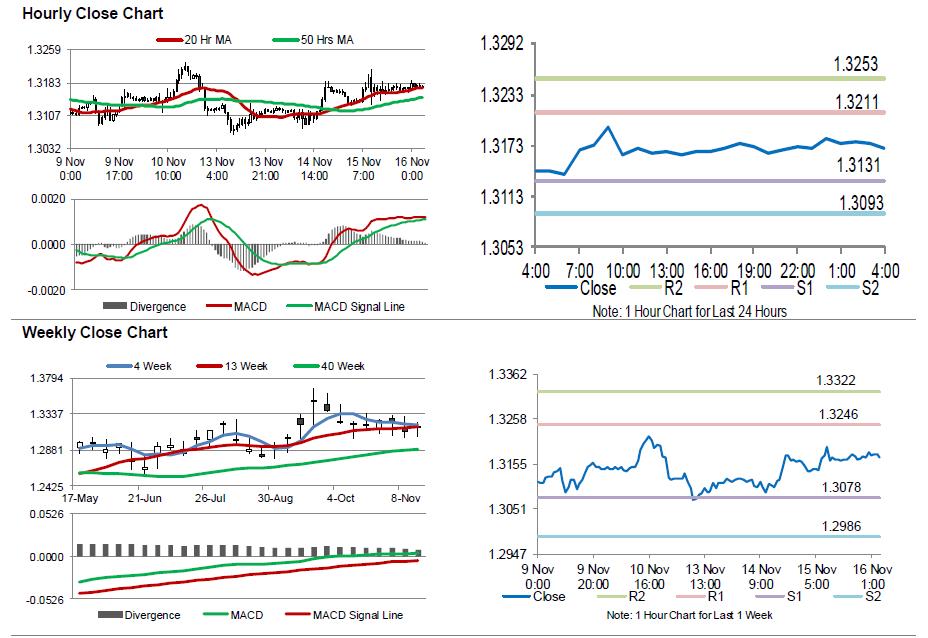

In the Asian session, at GMT0400, the pair is trading at 1.3170, with the GBP trading a tad higher against the USD from yesterday’s close.

The pair is expected to find support at 1.3131, and a fall through could take it to the next support level of 1.3093. The pair is expected to find its first resistance at 1.3211, and a rise through could take it to the next resistance level of 1.3253.

Moving ahead, market participants will focus on Britain’s retail sales data for October, due to release in a few hours. Also, a speech by the Bank of England (BoE) Governor, Mark Carney, due later in the day, will keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.