For the 24 hours to 23:00 GMT, the GBP rose 0.41% against the USD and closed at 1.2538, after UK’s ILO unemployment rate remained steady at an eleven-year low level of 4.7% in the three months to February, in line with market expectations.

However, the nation’s average earnings excluding bonus rose 2.2% YoY in the three months through February, rising at its weakest pace in seven months, indicating that consumer spending is unlikely to contribute to economic growth in the first quarter of 2017. The average earnings excluding bonus had recorded a revised gain of 2.4% in the November-January 2017 period, while markets expected for a rise of 2.1%.

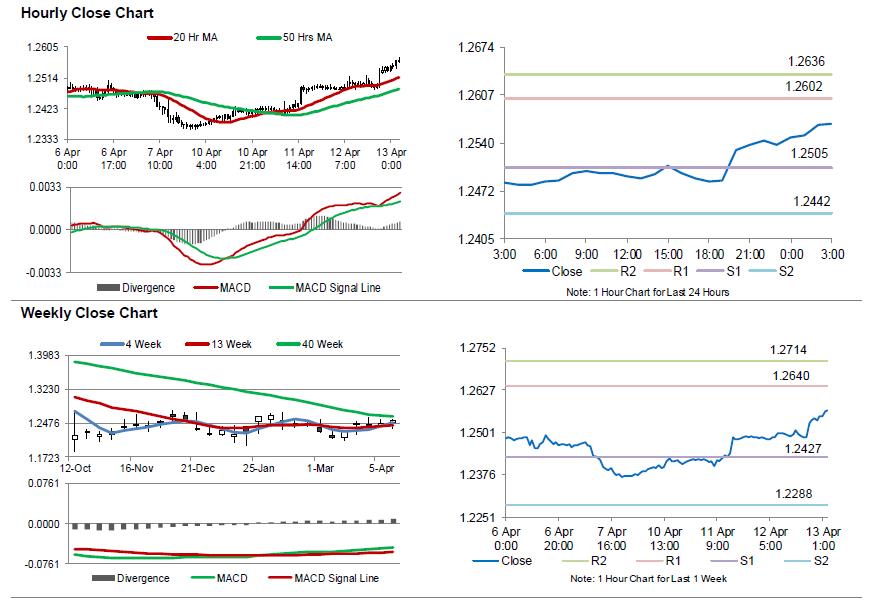

In the Asian session, at GMT0300, the pair is trading at 1.2567, with the GBP trading 0.23% higher against the USD from yesterday’s close.

Data released overnight indicated that the nation’s RICS house price balance remained steady at a level of 22.0 in March, in line with market expectations.

The pair is expected to find support at 1.2505, and a fall through could take it to the next support level of 1.2442. The pair is expected to find its first resistance at 1.2602, and a rise through could take it to the next resistance level of 1.2636.

Moving ahead, the Bank of England’s (BoE) credit conditions survey report, set to release in a few hours, will be eyed by market participants.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.