For the 24 hours to 23:00 GMT, the GBP declined 1.27% against the USD and closed at 1.2921, amid uncertainty surrounding Britain’s trade talks with the European Union and government plans to boost spending.

On the macro front, UK’s consumer price index (CPI) rose 1.8% on an annual basis in January, marking its highest level since July and led by higher petrol prices. In the previous month, the CPI had recorded a rise of 1.3%. Additionally, the output producer price index climbed 1.1% on a yearly basis in January, more than market consensus for an increase of 1.0% and compared to a rise of 0.9% in the prior month. Moreover, the retail price index advanced 2.7% on an annual basis in January, compared to a rise of 2.2% in the earlier month. Furthermore, the DCLG house prices rose 2.2% on a yearly basis in December, registering its strongest growth since October 2017 and compared to a revised rise of 1.7% in November.

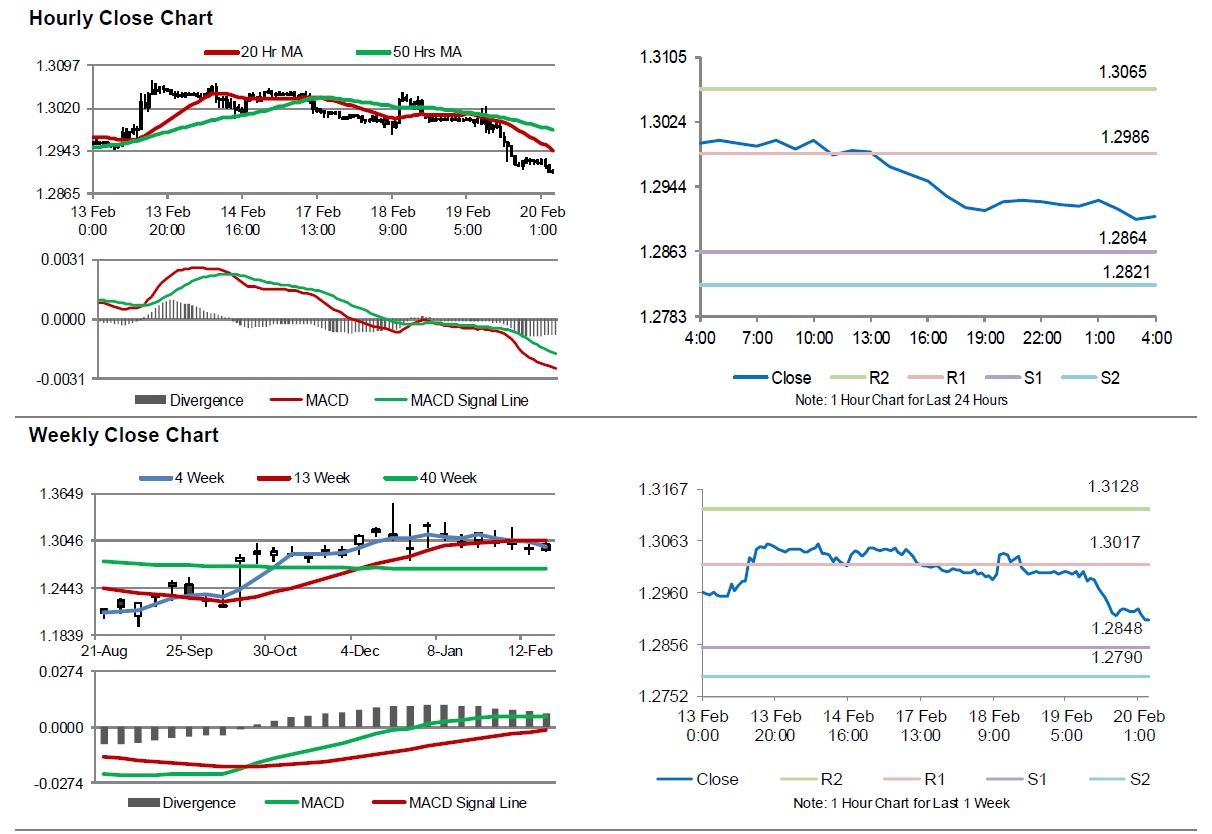

In the Asian session, at GMT0400, the pair is trading at 1.2906, with the GBP trading 0.12% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2864, and a fall through could take it to the next support level of 1.2821. The pair is expected to find its first resistance at 1.2986, and a rise through could take it to the next resistance level of 1.3065.

Going ahead, traders would focus on UK’s retail sales data for January and the CBI industrial trends orders for February, due to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.