For the 24 hours to 23:00 GMT, the GBP declined 0.25% against the USD and closed at 1.2995, amid reports that British Prime Minister, Theresa May, could face no confidence vote.

On the macro front, UK’s consumer price index (CPI) climbed 2.4% on an annual basis in October, compared to a similar rise in the prior month. Market participants had envisaged the CPI to advance 2.5%. Additionally, the nation’s retail price index rose 3.3% on a yearly basis in October, falling short of market anticipation for a gain of 3.4%. In the preceding month, the index had registered a similar rise. Also, the house price index jumped 3.5% on an annual basis in September, overshooting market expectations for a climb of 3.2%. The index had recorded a revised rise of 3.1% in the prior month. Further, the non-seasonally adjusted output producer price index (PPI) climbed 3.3% on a yearly basis in October, more than market expectations. The output PPI had risen 3.1% in the previous month.

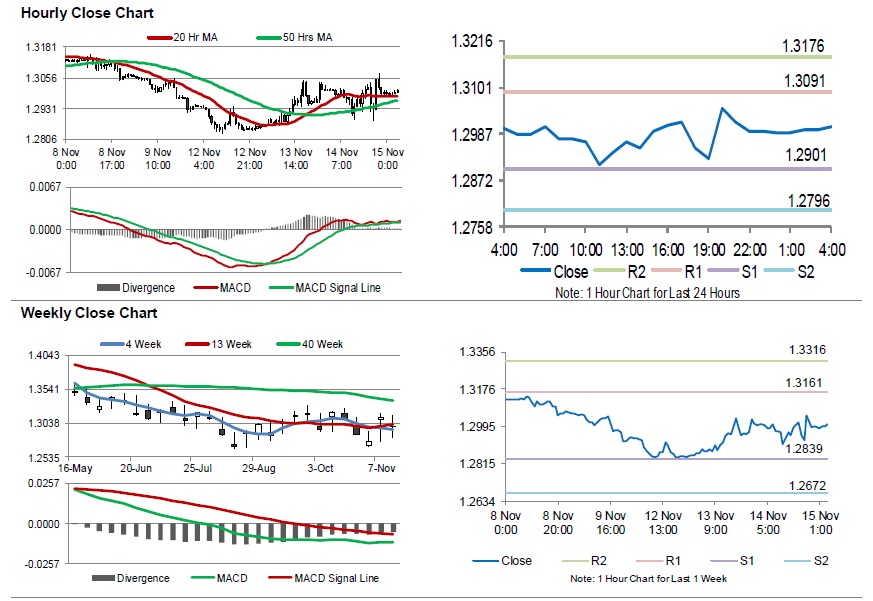

In the Asian session, at GMT0400, the pair is trading at 1.3005, with the GBP trading 0.08% higher against the USD from yesterday’s close, after the UK Cabinet approved President, Theresa May’s draft Brexit plan.

The pair is expected to find support at 1.2901, and a fall through could take it to the next support level of 1.2796. The pair is expected to find its first resistance at 1.3091, and a rise through could take it to the next resistance level of 1.3176.

Moving forward, investors would await UK’s retail sales for October, set to release in a few hours

The currency pair is trading above its 20 Hr and 50 Hr moving averages.