For the 24 hours to 23:00 GMT, the GBP declined 0.65% against the USD and closed at 1.3276, on the back of bearish manufacturing sector report from the UK.

Data revealed that Britain’s Markit manufacturing PMI eased more-than-expected to a level of 55.90 in September, offering latest sign of the growing hit to the British economy from Brexit uncertainties. In the previous month, the PMI had registered a revised reading of 56.7, while investors had anticipated for a fall to a level of 56.2.

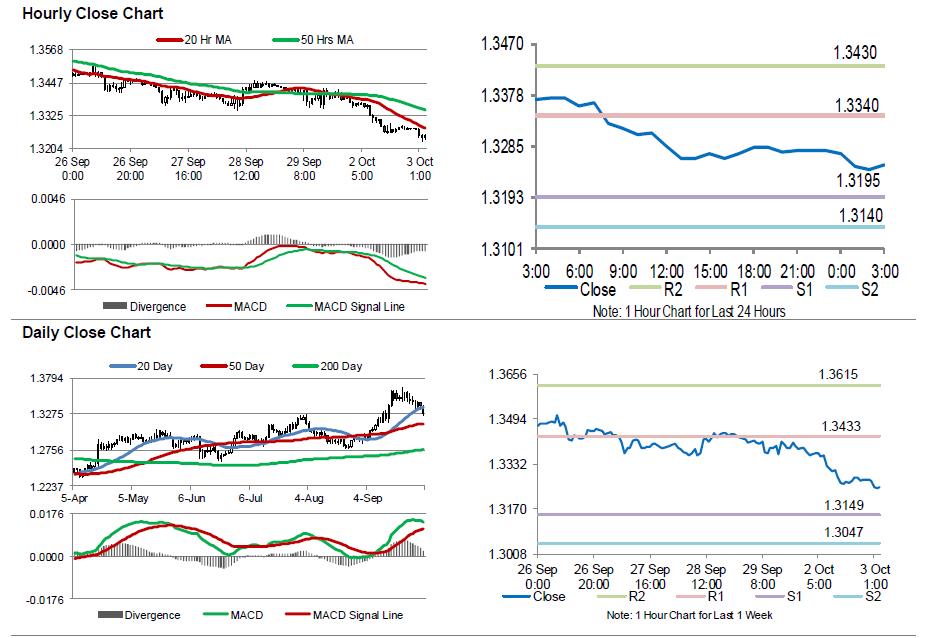

In the Asian session, at GMT0300, the pair is trading at 1.3250, with the GBP trading 0.2% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.3195, and a fall through could take it to the next support level of 1.314. The pair is expected to find its first resistance at 1.3340, and a rise through could take it to the next resistance level of 1.3430.

Going ahead, investors will draw their attention to UK’s Markit construction PMI for September, slated to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.