For the 24 hours to 23:00 GMT, the GBP rose 0.3% against the USD and closed at 1.2936, after Britain’s manufacturing sector surprised with a robust performance in April.

The Markit manufacturing PMI in UK unexpectedly jumped to a level of 57.3 in April, expanding at its quickest pace in three years, buoyed by strong global demand, thus painting a largely bright picture of the economy and tempering worries about a Brexit-driven economic slowdown. The PMI had registered a reading of 54.2 in the previous month, while market participants had envisaged for a drop to a level of 54.0

In the Asian session, at GMT0300, the pair is trading at 1.2941, with the GBP trading slightly higher against the USD from yesterday’s close.

Overnight data indicated that the nation’s BRC shop price index fell 0.5% on an annual basis in April, meeting market expectations and following a drop of 0.8% in the prior month.

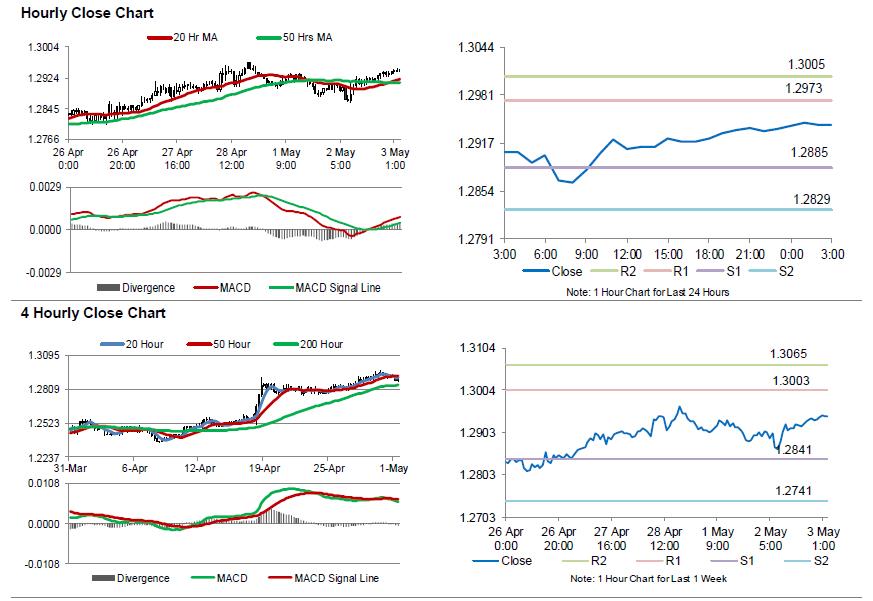

The pair is expected to find support at 1.2885, and a fall through could take it to the next support level of 1.2829. The pair is expected to find its first resistance at 1.2973, and a rise through could take it to the next resistance level of 1.3005.

Moving ahead, market participants await the release of UK’s Markit construction PMI for April, set to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.