For the 24 hours to 23:00 GMT, the GBP declined 0.61% against the USD and closed at 1.3181 on Friday.

On the data front, UK’s manufacturing PMI declined to a level of 52.0 in February, marking its lowest level in four-months and weighed down by looming Brexit uncertainties. In the prior month, the PMI had recorded a revised reading of 52.6. Meanwhile, Britain’s mortgage approvals for house purchases unexpectedly climbed to a level of 66.8K in January. In the preceding month, the mortgage approvals had registered a revised level of 64.5K. Furthermore, the nation’s net consumer credit recorded a rise of £1.1 billion in January, compared to a revised rise of £0.7 billion in the prior month. Market participants had expected the net consumer credit to record a gain of £0.8 billion.

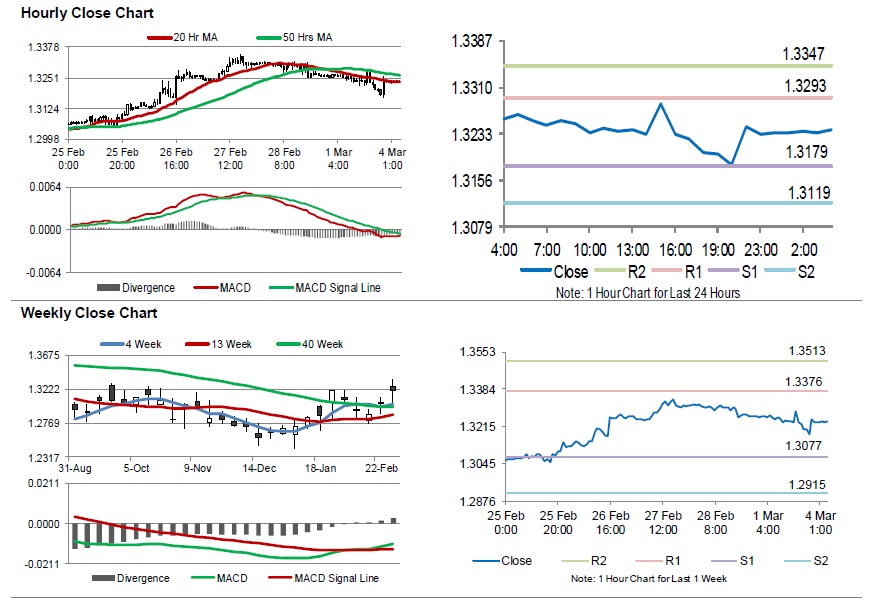

In the Asian session, at GMT0400, the pair is trading at 1.3240, with the GBP trading 0.45% higher against the USD from Friday’s close.

The pair is expected to find support at 1.3179, and a fall through could take it to the next support level of 1.3119. The pair is expected to find its first resistance at 1.3293, and a rise through could take it to the next resistance level of 1.3347.

Trading trend in the British Pound today, is expected to be determined by UK’s Markit construction PMI for February, set to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.