For the 24 hours to 23:00 GMT, the GBP declined 1.16% against the USD and closed at 1.3609, after Britain’s manufacturing sector showed a poor performance in April.

Data revealed that UK’s Markit manufacturing PMI slid to a 17-month low level of 53.9 in April, casting fresh concerns over the health of the nation’s economy. The PMI had recorded a revised level of 54.9 in the prior month, while markets were expecting for a fall to a level of 54.8.

Other data revealed that the nation’s mortgage approvals fell more-than-estimated to a level of 62.9K in March, hitting a 3-month low level and reinforcing a picture of sluggish property market. Mortgage approvals had recorded a revised reading of 63.8K in the previous month, while markets had anticipated for a fall to a level of 63.0K. Also, the nation’s net consumer credit grew £0.3 billion in March, rising at its weakest pace since November 2012. Market participants had envisaged net consumer credit to rise by £1.4 billion, after registering a revised gain of £1.7 billion in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.3613, with the GBP trading slightly higher against the USD from yesterday’s close.

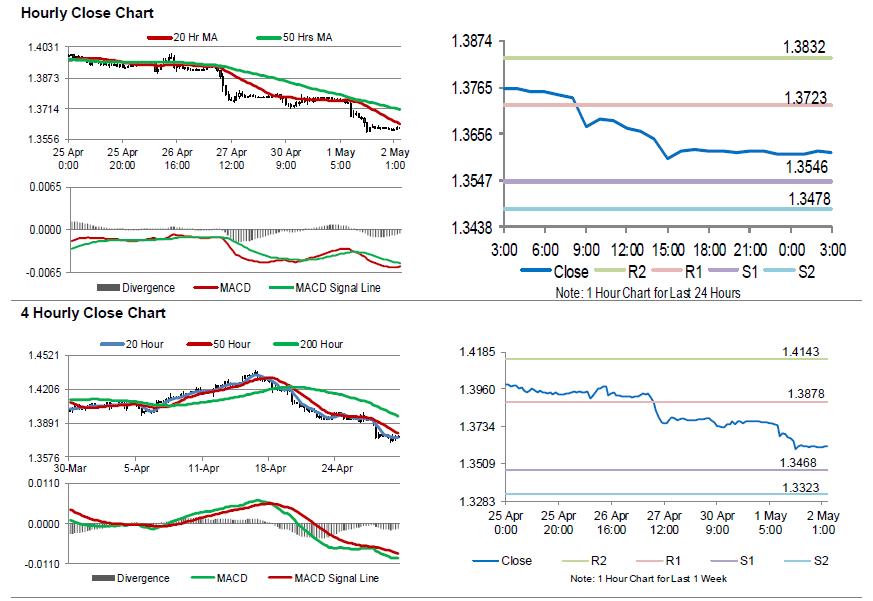

The pair is expected to find support at 1.3546, and a fall through could take it to the next support level of 1.3478. The pair is expected to find its first resistance at 1.3723, and a rise through could take it to the next resistance level of 1.3832.

Moving ahead, traders would closely monitor Britain’s Markit construction PMI for April, slated to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.