For the 24 hours to 23:00 GMT, the GBP marginally declined against the USD and closed at 1.2922.

On the data front, Britain’s mortgage approvals for house purchases jumped to a sixteen-month high level of 68.7K in July, offering tentative signs that the nation’s housing market could be picking up. In the prior month, number of mortgage approvals for house purchases had registered a revised reading of 65.3K, while investors had expected for an advance to a level of 65.5K. Meanwhile, the nation’s net consumer credit rose less-than-anticipated by £1.2 billion in July, rising at its weakest pace in seven months and compared to a revised advance of £1.4 billion in the previous month. Markets were expecting net consumer credit to increase by £1.5 billion.

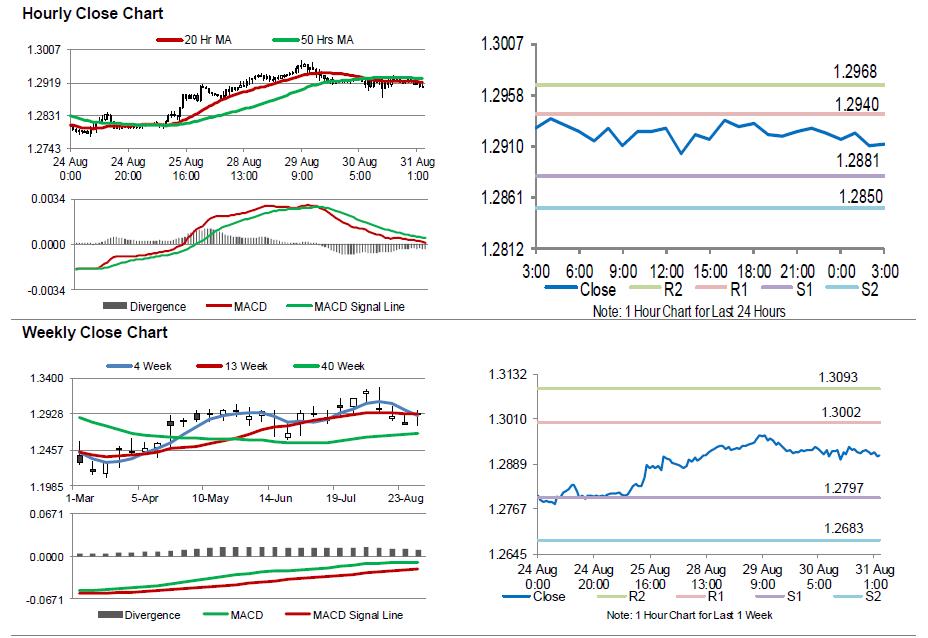

In the Asian session, at GMT0300, the pair is trading at 1.2911, with the GBP trading 0.09% lower against the USD from yesterday’s close.

Overnight data showed that the nation’s GfK consumer confidence unexpectedly improved to a level of -10.0 in August, despite gloomier economic outlook. The index had registered a reading of -12.0 in the prior month, while market participants had envisaged it to ease to a level of -13.0.

The pair is expected to find support at 1.2881, and a fall through could take it to the next support level of 1.2850. The pair is expected to find its first resistance at 1.2940, and a rise through could take it to the next resistance level of 1.2968.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.